- Print

- DarkLight

- PDF

Common Check Run errors with solutions

Occasionally one or more steps in the check run process will fail, indicated by a red X next to the step. The error logs will indicate which grant payments have errors and what those errors are. If the logs within the check run do not indicate why the check run will not complete, the user can find more information in Settings > View Activity > System Logs.

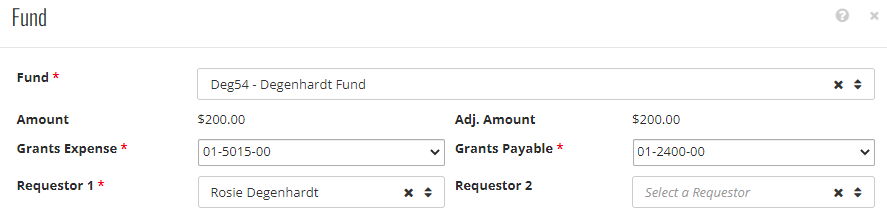

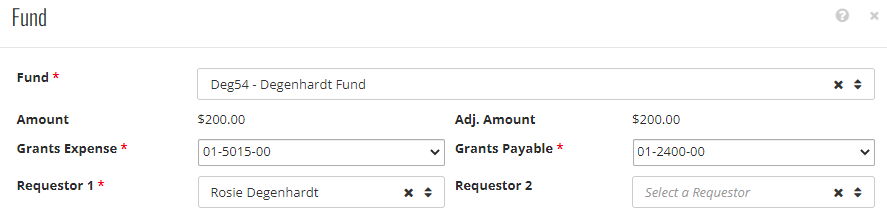

INVALID: No DRAccountCode selected for fund ‘Deg54’

Open the grant > Funds Tile > Click the ellipses to Edit the Fund > use the dropdown lists next to Grant Expense and Grant Payable fields to re-select the proper codes > Save.

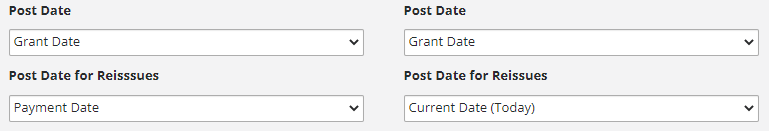

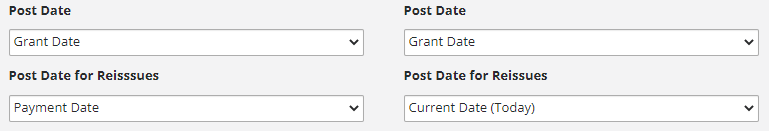

INVALID: The Postdate must be in an open fiscal period.

First, identify what FC Grants is recognizing as the post date. See this setting in Settings > System > Business Rules > Finance.

Change the date on the grant to be within a fiscal period.

If the payment is in an open fiscal year, but perhaps dated for last month, check with your finance team to see if the prior month has been closed. In this case, change the post to be within an open month according to finance.

Alternatively, if the grant is missing a Grant Date (not received date) this error will also present. Open the grant and update the Grant Date > Save.

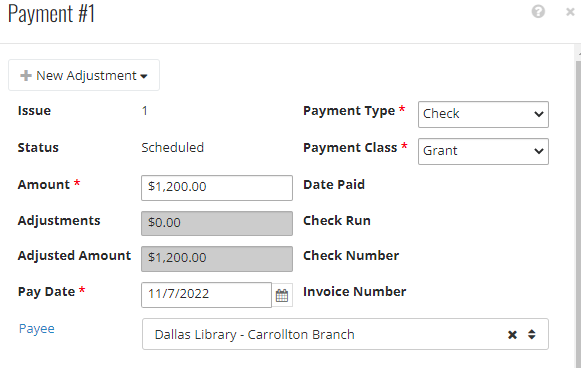

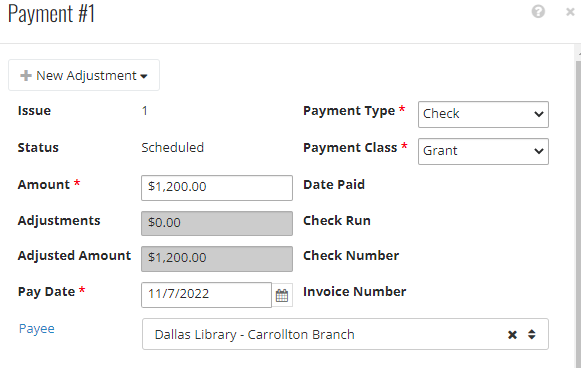

INVALID: Payment 1 does not have a payee selected.

Open the grant > Payments tile > open the payment using the ellipses > Edit > add the payee in the Payee field. Save.

INVALID: Payment 1 - Payee (XYZ) does not have a link to a Vendor in the Finance System.

This is likely caused by duplicate consistent records for the Payee. One record with an RE Key and the other with an FE Key. Search for duplicates on the Grants > Constituents > grid search to see if a duplicate exists. Ensure the RE and FE Key columns are turned on to easily identify if this is the case.

To merge duplicates use the Constituent Utility Instructions.

Or, open the grant > Payments tile > open the payment using the ellipses > Edit > search for the payee, add the payee with an FE Key in the Payee field - search either FC Grants or the Finance system. The record with an associated vendor record will likely have an address. Save.

Continue on with processing.

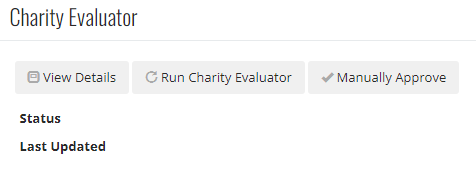

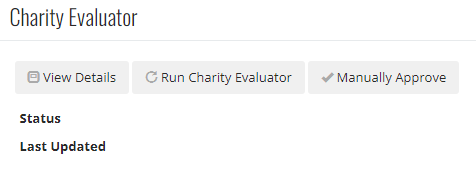

INVALID: The Selected Recipient has not been verified with an IRS Charity Check.

Navigate to the Recipient record and either click Run Charity Evaluator to verify the organization against the IRS database or Manually Approve the recipient and continue with the check run.

INVALID: No Requestor selected for fund '1030'

Open the fund record and add a Requestor with the appropriate relationship to the fund. Save the record.

Open the grant or transfer locate the Funds tile and use the ellipses to edit the fund.

Use the Requestor 1 field to add a related Requestor. Save.

Re-run the check run step.

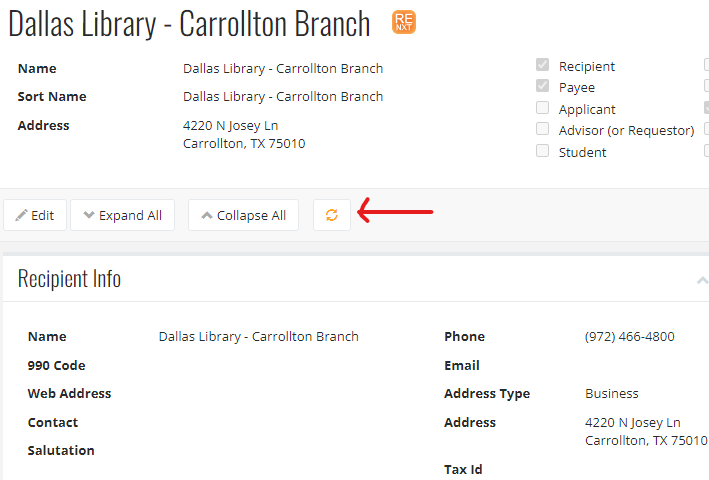

INVALID: The Selected Recipient is not a valid recipient.

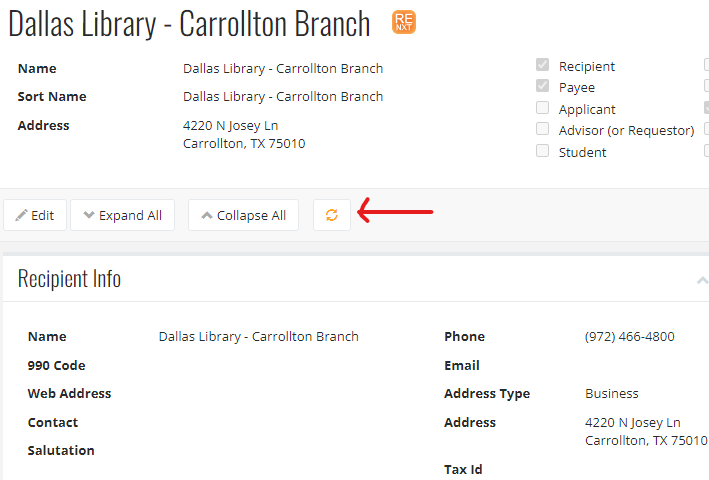

Open the grant > Click on the recipient to open the constituent record. Verify the Recipient check box is marked.

If not, update the Constituent code in CRM, and use the refresh button indicated below.

Run the finance steps again after the records show a Recipient code.

Invoice could not be created, DRAccountCode " was not found in FE

This error can be caused by a mismatch between the fund set on the grant and the fund used for the payment component. The fund listed on the grant and within the payment should be the same but can differ if the payment was generated and then the granting fund changed. To realign these pieces follow the steps below.

Remove the grant payment from the checkrun.

Open the grant > scroll to find the Payment tile.

Use the 3 dots to edit the existing payment and take a screenshot to reference details (if needed).

Close out of the existing payment and use the three dots to delete the payment.

Click "New" to generate a new payment > add the same information from the screenshot and save.

Add this grant payment back on a check run for finance processing.