- Print

- DarkLight

- PDF

Finance information for the organization can be configured in the Business Rules tab. For detail on the Banking section, read the article Configuring Bank Information for Check Runs.

Finance Account Configuration

Use this section to configure finance accounts and set the default checking fund.

To set the default checking fund, select the account from the Default Checking Fund dropdown list.

The left-hand pane contains a list of account types. Click on an account type to see the accounts associated with payments for this account type. Example: The image above has Grant Expenses selected. The 4 accounts associated with payments for grant expenses are listed in the right-hand pane.

Click the + button to associate a new account with the selected account type. Use the ellipsis icon and choose Delete to remove an account association from the selected account type.

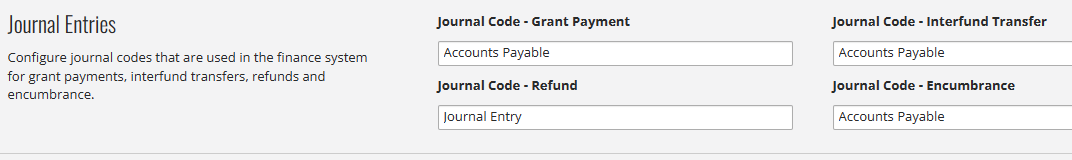

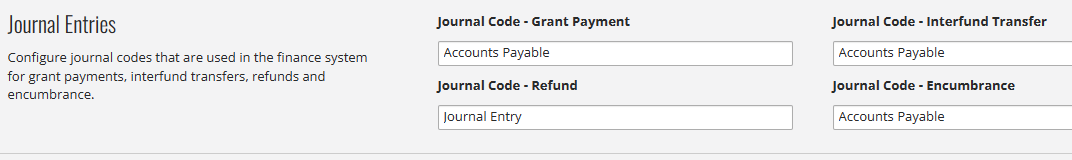

Journal Entries

Use the Journal Entries section to enter the journal codes as configured in the Finance system. Journal Codes are configured for Grant Payment, Refund, Interfund Transfer, and Encumbrance.

Invoices

Invoices

Use the Invoices section to configure settings for invoice numbers and date preferences to use when creating accounts payable invoices.

The left-hand pane shows Standard Invoice and Encumbrance Invoice. Click on one to show formatting options in the right-hand pane. Example: The image above has Standard Invoice selected. The formatting options in the right-hand pane are associated with standard invoices.

Format - The Format field displays the current format in use for the selected invoice type. Inserted fields display between brackets.

Insert - Use the dropdown in this field to select the elements to include in the invoice number format.

Preview - This section displays a preview of the invoice number format populated as specified in the Format field.

Invoice Date - Use the dropdown list to select the invoice date to default when an invoice is created. The options are None, Current Date (Today), Grant Date, or Payment Date.

Due Date - Use the dropdown list to select the due date to default on invoices. The options are None, Current Date (Today), Grant Date, or Payment Date.

Post Date - Use the dropdown list to choose when a new invoice posts. The options are None, Current Date (Today), Grant Date, or Payment Date.

Post Date for Reissues - Use the dropdown list to choose when an invoice posts when reissued. The options are None, Current Date (Today), and Payment Date.

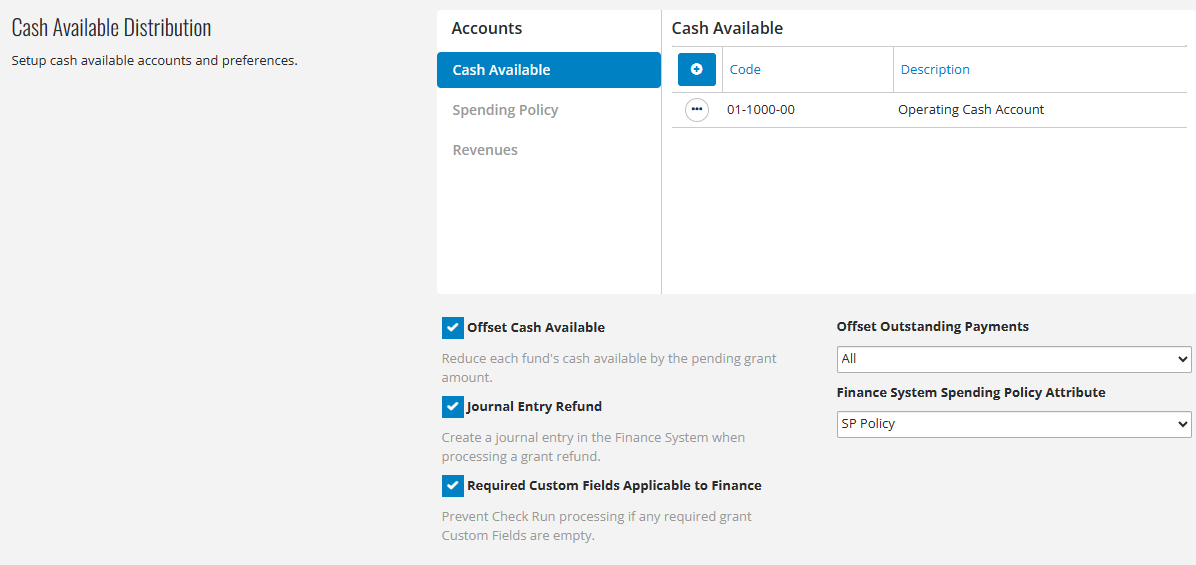

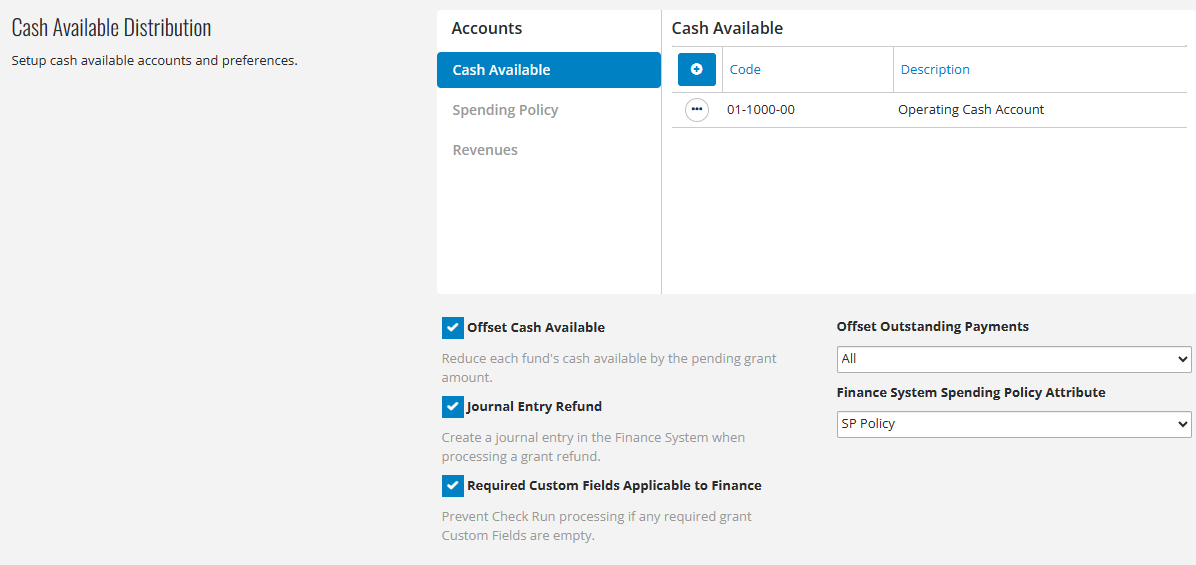

Cash Available Distribution

The Cash Available Distribution section is used to set up cash available accounts and preferences.

NoteMany foundations have custom database functions for calculating balances. Those foundations should not use these settings.

The left-hand pane shows Cash Available, Spending Policy, and Revenues. Click on one to show associated accounts in the right-hand pane. Example: The image above has Cash Available selected. The accounts associated with Cash Available show in the right-hand pane.

Click the + button to associate a new account with the selected account type. Use the ellipsis icon and choose Delete to remove an account association from the selected account type.

Offset Cash Available - Check this checkbox to reduce each fund's cash available balance by the amount of pending grants. If this is checked, select which pending grants to include by using the "Offset Outstanding Payments" option (see below).

Journal Entry Refund - Check this checkbox to create a journal entry in the Finance system when a grant refund is processed.

Required Custom Fields Applicable to Finance - Check this checkbox to prevent check run processing when any required grant custom fields are empty.

Offset Outstanding Payments - If the "Offset Cash Available" checkbox is selected, choose one of these options to select which payments to subtract from each fund's available balance.

Finance System Spending Policy Attribute - If the foundation uses spending policies in the integrated finance system, select the appropriate spending policy attribute here. Note that the selected attribute must have a Yes/No data type in the finance system.

Fiscal Year Configuration

This section is used to configure fiscal year settings for the foundation.

Select the month and day for the beginning of the fiscal year. Example: A fiscal year that begins on January 1 is entered as 01/01 (MM/DD).

Transaction Codes

Transaction codes are optional dimensions in an integrated finance system, used to categorize information for reports and closing of fiscal years. Up to 5 transaction codes can be configured in FCG to be used during check run processing.

T Code View Name - The name of the database view customized to define the Transaction Code values for each Grant record. This view can only be customized by NPact staff, and this field should not be modified by users.

T Code [X] Name - If Transaction Codes are used, their names can be set in these 5 fields to be accessed by custom reports.

Invoices

Invoices