- Print

- DarkLight

- PDF

Article summary

Did you find this summary helpful?

Thank you for your feedback

Entering Interim Market Values

The Interim Market Value Entry tool allows you to manually enter market values for investment accounts as of a selected date (rather than using the ending market values from the previous cycle), and then create FACTS account and pool balance records.

Once you enter the market values, run Pool Allocation Processing from the resulting report to create the Fund Balance records.

IMPORTANT: This utility should not be used for regular FACTS processing.

- In the General Ledger module, click the Journal Entry supertab, and then click the Automatic Entries tab.

- Select Asset Re-Balancing Module from the Automatic Entries list, and then click the Run Process button.

- In the Asset Rebalancing module, click the Processing tab.

- Select Interim Market Value Entry from the Rebalancing Processes list and then click the Run Process button. The Interim Market Value Entry window opens.

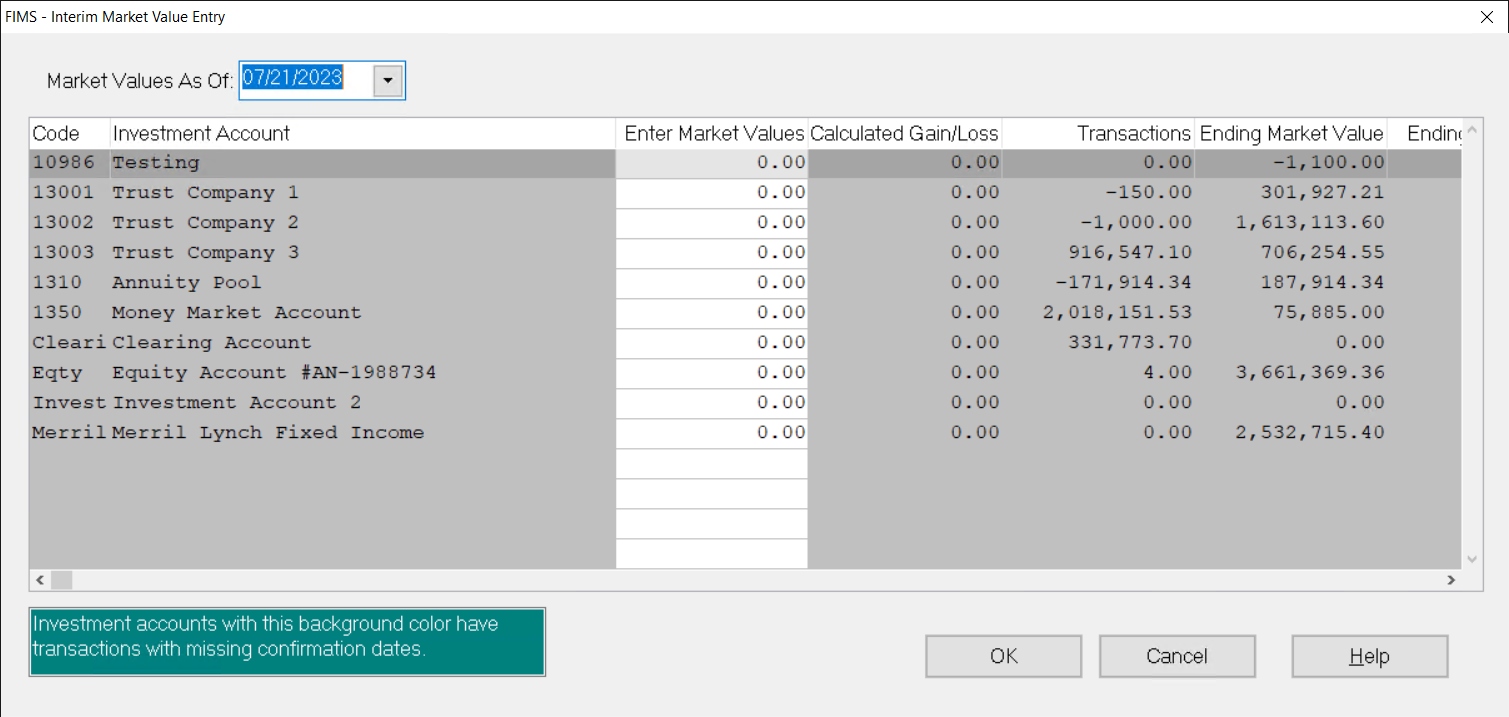

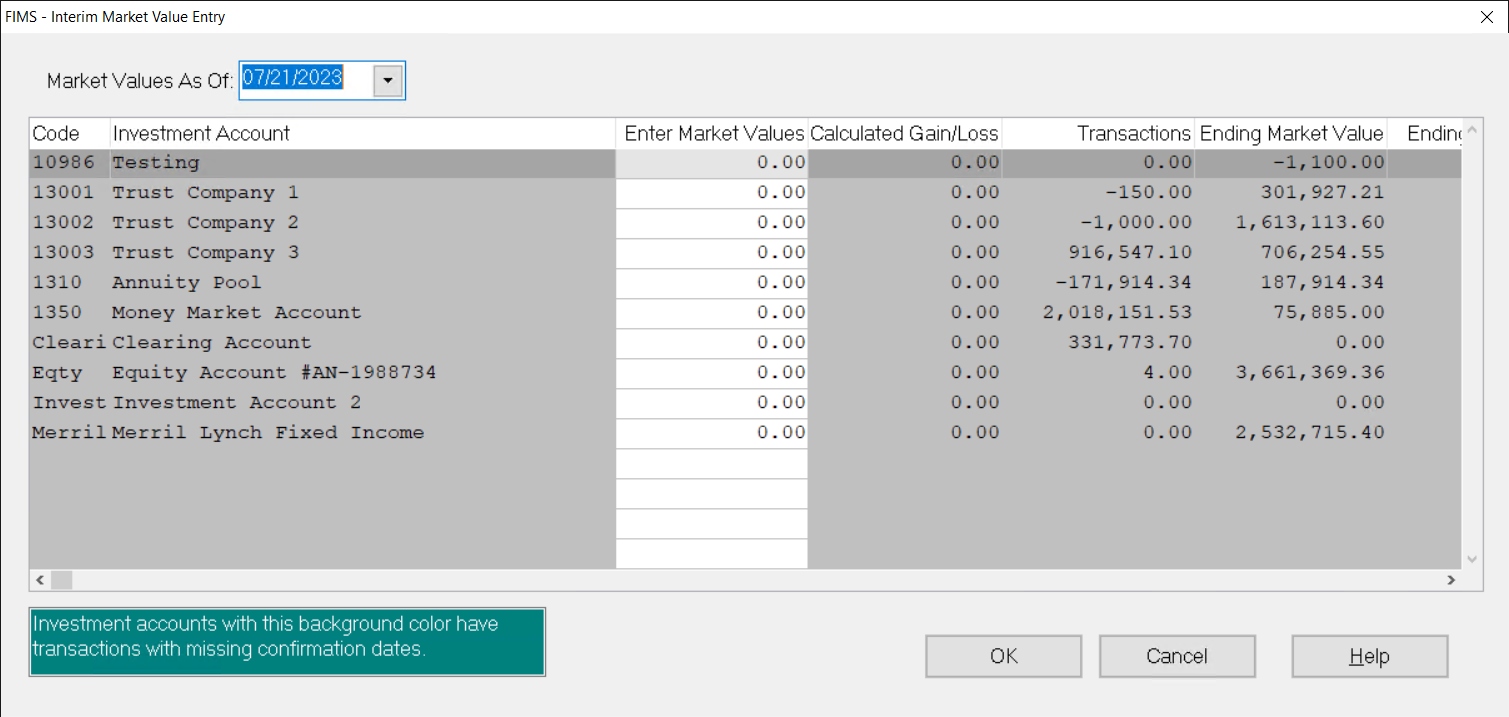

Interim Market Value Entry Window NOTE: If any of the accounts have transactions with missing confirmation dates, they will be highlighted in the list. You will need to enter the missing confirmation dates before proceeding.

NOTE: If any of the accounts have transactions with missing confirmation dates, they will be highlighted in the list. You will need to enter the missing confirmation dates before proceeding.

- Enter the desired Market Values As Of date. The default value is today's date.

- In the Enter Market Values field for each of the desired investment accounts, enter the current market value for the selected date.

- Click OK.

- Verify the information on the report that opens, and then click Allocate on the FIMS Viewer menu to launch the pool allocation.

Was this article helpful?