- Print

- DarkLight

- PDF

FACTS – G/L Comparison Report

This report checks that the pool balances in FACTS (in the F-Fund-balance records) are exactly the same as those tracked by the pooled asset account in General Ledger.

The report displays the FACTS Balance, the General Ledger Balance, and the Variance (which should be zero).

If any of the Funds have a variance between FACTS and General Ledger, you should correct it as soon as possible.

NOTE: The balance between FACTS and General Ledger is so essential to the integrity of your fiscal system that you should run this report along with the Edit Report before posting the allocations from the current cycle back to General Ledger.

NOTE: You can access this report from anywhere in FIMS by selecting Reports > FACTS > FACTS – G/L Comparison Report.

Running the FACTS – G/L Comparison Report

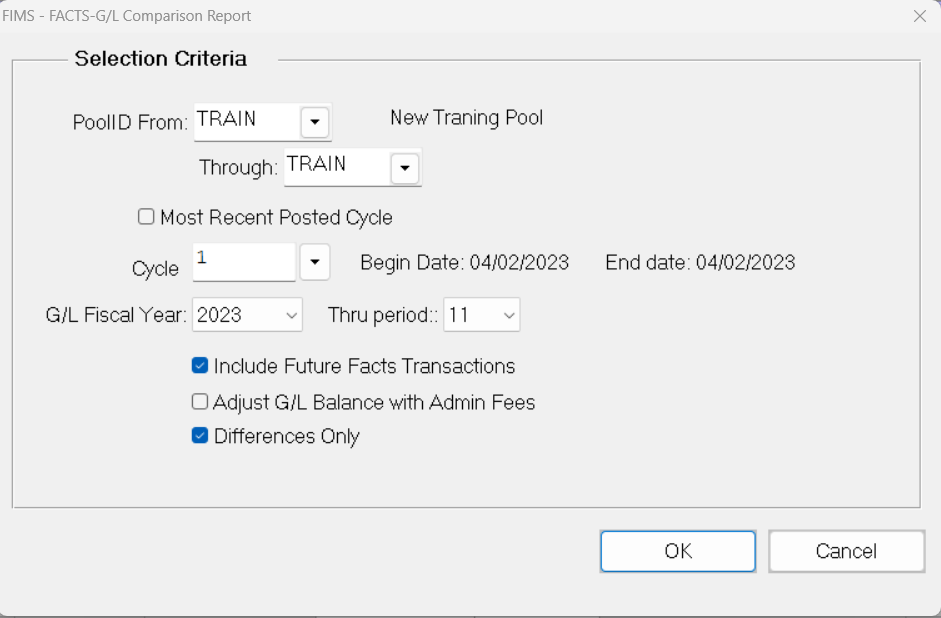

- In the FACTS module, select Reports > FACTS-GL Comparison Report. The FACTS – G/L Comparison Criteria window opens.

FACTS – G/L Comparison Criteria Window

- Click the arrow in the Pool drop-down box and select the desired pool.

- Enter the Cycle that you want to include on the report.

- Select the G/L Fiscal Year and Period that you want to compare with FACTS.

- If you want to include unposted transactions in the comparison, select the Include Future FACTS Transactions checkbox.

- If you want to include administrative fees in the General Ledger balance for the report, select the Adjust G/L Balance with Admin Fees checkbox.

- Click OK.

- Verify the Send To destination, and then click the Run Report button.

Tip: Variances between FACTS and General Ledger

There are several situations that may cause a variance between FACTS and General Ledger on the FACTS – G/L Comparison Report.

- If you run the report for every cycle, as an adjunct to the FACTS Edit report, it is likely that there is a difference between the unposted transactions that came into FACTS from the General Ledger and the corresponding historic General Ledger Journal entries. To check this possibility, run the Transaction History Listing report to list the transactions, and then run the Journal History Report to see the Ledger History of the Pooled Asset Account. You can sort and compare the items using the FACTS Transaction Document Number and the Journal Number, which will be the same. You can then check the items to make sure there is a one-to-one correspondence, see if any transaction amounts were edited, or see if manual entries cause discrepancies.

- If any General Ledger Journal entries were made to a Pooled Asset Account with a Journal Key code of FA, it could cause an imbalance between FACTS and General Ledger. The FA Journal Key is used by the FACTS posting process, to prevent FACTS transactions from being created when the entries are posted.

- If the General Ledger Journal entries that were automatically created by posting FACTS (with an FA Journal Key code) were not posted in General Ledger, the FACTS balances will reflect the change, but the General Ledger Pooled Asset Account balances will not.

- If you keep the Pooled Asset account at Book, and also have an Adjustment to Market account where unrealized gains and losses are offset, check to see if any manual General Ledger Journal entries were made to the Adjustment to Market account. These entries would affect the General Ledger side of the report but would not result in FACTS transactions.

Tip: Running the FACTS – G/L Comparison Report for a Past Period

In order to compare FACTS Fund balances with the GL asset in Pool account balances as of the end of a specific past period, use the following procedure.

This is especially useful if you find a persistent variance and want to find the cycle where the variance originated.

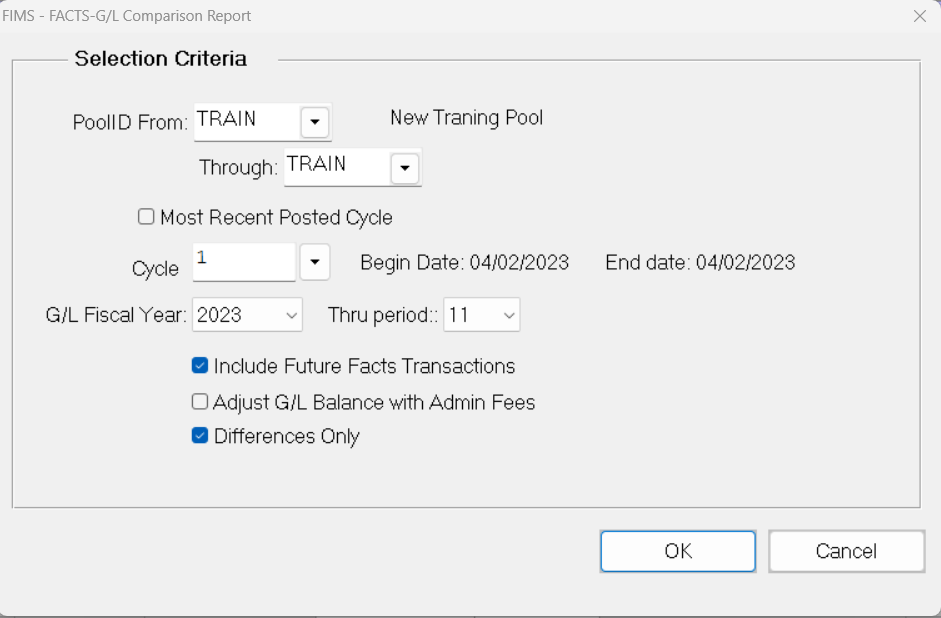

- In the FACTS module, select Reports > FACTS-GL Comparison Report. The FACTS – G/L Comparison Criteria window opens.

- Click the arrow in the Pool drop-down box and select the desired pool.

- Enter the desired posted Cycle.

- Select the G/L Fiscal Year and Period that you want to compare with FACTS.

- Clear the Include Future FACTS Transactions checkbox.

- If you post administrative fees to the last day of a period (after FACTS allocations have been posted back to General Ledger), and subsequently change the Confirm Date of the resulting FACTS transactions to the first day of the next cycle, select the Adjust G/L Balance with Admin Fees checkbox. Otherwise, clear this checkbox.

- Click OK.

- Verify the Send To destination, and then click the Run Report button.

NOTE: Using this method to run the report may legitimately display a variance if one or more items were in transit when the Confirm Date was shifted to the next Cycle. However, it is still useful for identifying when a persistent imbalance first appeared.