- Print

- DarkLight

- PDF

Article summary

Did you find this summary helpful?

Thank you for your feedback

The most common way to handle a multi-year Interfund is to create an Interfund grant for the entire multi-year commitment.

Answer:

There are many variations that can be done to handle a multi-year Interfund grant, but the most common is to create an Interfund grant for the entire multi-year commitment. For this example, let us assume that we are planning on transferring $1000 to another fund each year for 5 years for a total of $5000.

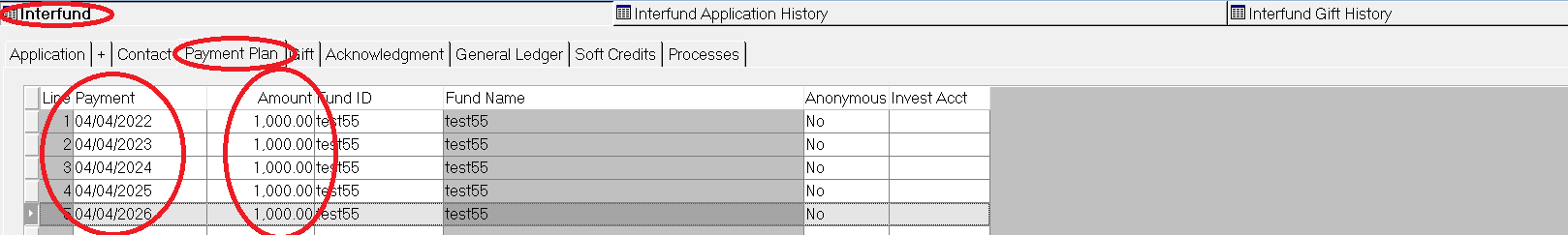

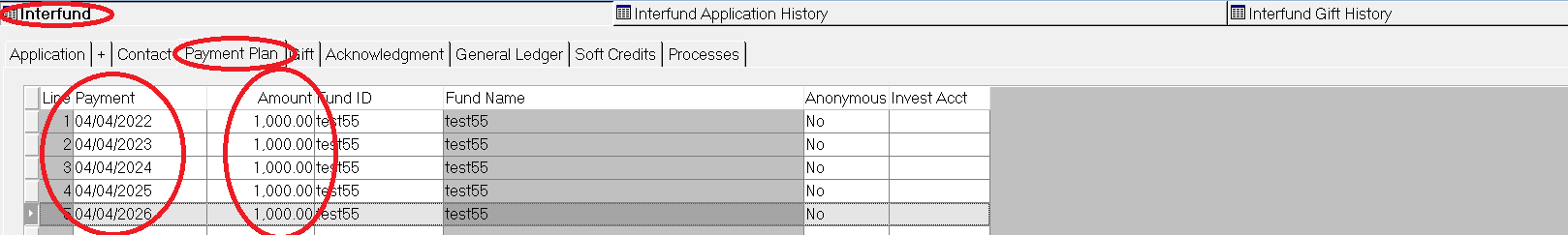

2. Edit the application payment plan to have 5 lines- one for each year of the commitment.

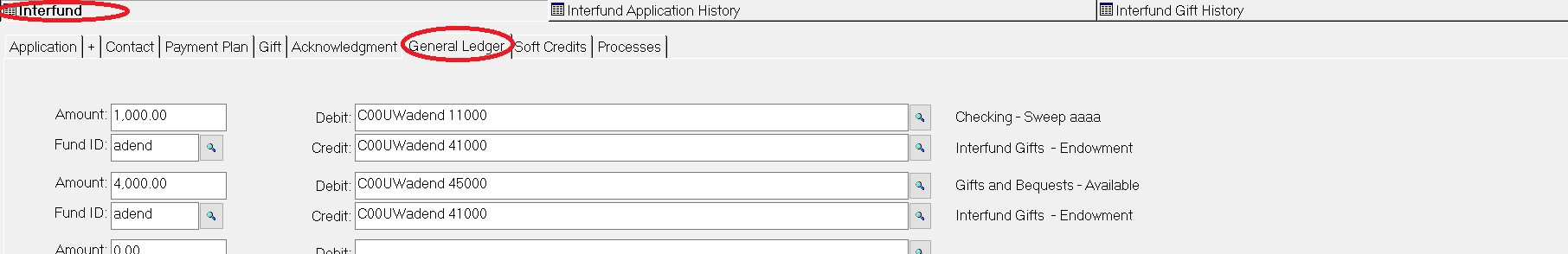

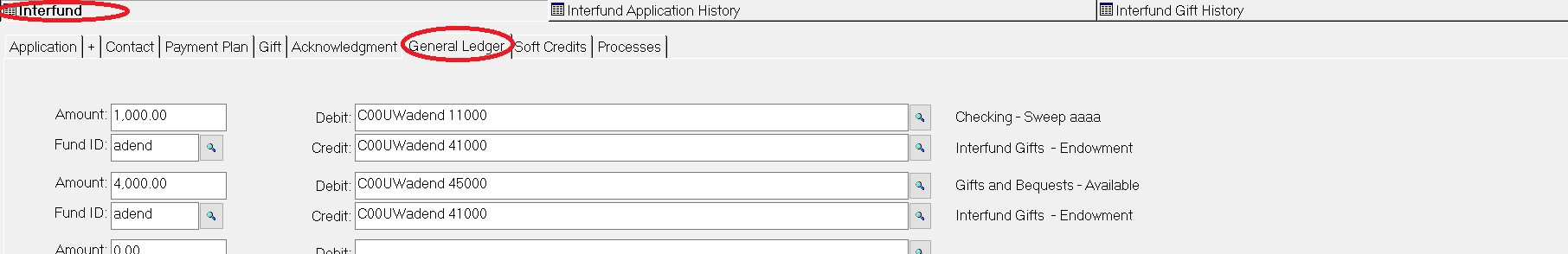

3. Edit the gift to have two entries on the General Ledger tab. One will be for the first payment of $1000 and the other for the remaining $4000. The GL accounts for the first $1000 can remain as generated, but the Debit account for the $4000 should be changed to point to a receivable account.

The screenshot below is just an example:

4. When the gift and grant are modified you can post them through to the GL.

5. Process either a real or hand check for the first annual payment in the AP module. Subsequent year payments can be handled in a similar manner- either a real or hand check.

6. When you process the future year payment you need to either enter a non-gift to record the receipt of the payment and the decrease in the receivable or process a journal entry. Which option you take will depend on your reporting needs.

- Create an Interfund Transaction in the Interfund module for the $5000. In the wizard the most important thing is to remember to uncheck automatic payment and make sure print check is selected. Click Create Interfund (not Create/Post).

2. Edit the application payment plan to have 5 lines- one for each year of the commitment.

3. Edit the gift to have two entries on the General Ledger tab. One will be for the first payment of $1000 and the other for the remaining $4000. The GL accounts for the first $1000 can remain as generated, but the Debit account for the $4000 should be changed to point to a receivable account.

The screenshot below is just an example:

4. When the gift and grant are modified you can post them through to the GL.

5. Process either a real or hand check for the first annual payment in the AP module. Subsequent year payments can be handled in a similar manner- either a real or hand check.

6. When you process the future year payment you need to either enter a non-gift to record the receipt of the payment and the decrease in the receivable or process a journal entry. Which option you take will depend on your reporting needs.

Was this article helpful?