- Print

- DarkLight

- PDF

How do I keep from over-granting my Non-Endowed (Pass-through) fund when pledges are involved?

When I post a pledge to any fund, the Pledge Receivable account is debited and the Pledge Income account is credited. This increases the fund balance for the fund. In the situation of a Pass-through fund, there is usually no actual spending policy or Available to Spend code used; the entire fund balance is available. While I possibly won't have the assets available to grant, I could conceivably commit funds that the fund ultimately may not have.

If I posted a pledge and then made grant commitments based on that pledge being part of the fund balance, and if the pledge was subsequently adjusted or written off, the fund balance would fall commensurately and might go negative. How do I keep this from happening?

Answer:

To avoid this scenario, you can create an Available to Spend code for your Pass-through funds that will deduct the Pledge Receivable amount from the fund balance, be available to alert you during grant entry and will appear on the Balance supertab in the Funds module:

- Select File Maintenance > Funds > Fund Code Maintenance > Available to Spend

- Click the New button in the upper left to add a new code

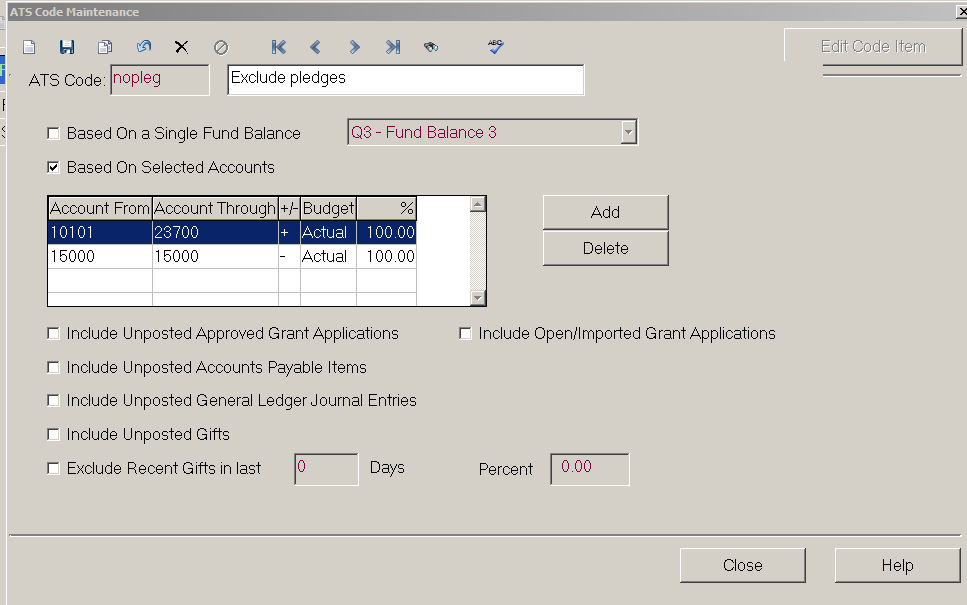

- Add a code and description

- Check the Based on Selected Accounts box

- In the accounts grid, add a range that includes all your asset and liability accounts (+), then another line with your Pledge Receivable account (-), which will effectively subtract your Pledge Receivable from the available fund balance.

- You may check any of the other boxes below if you wish to incorporate unposted entries into the calculation.

- Add this code to your Pass-through funds