- Print

- DarkLight

- PDF

IRS 990 Grantee Schedule Total for Section 3 for Scholarships does not Match Scholarship Total on Grant History Report

When running the Grant History Report and using Transaction Date of the date range for an entire year and filtering on just scholarships, the total scholarships does not match what shows on the IRS 990 Grantee Schedule report in section 3 for scholarships when there were no grants given to individuals, only scholarships were issued. Part 3 grants are either posted in the Scholarship module or tagged as grants to Individuals on the application. So, if a foundation does not have any grant applications to individuals then it is expected that the total in section 3 of the IRS 990 report would match the Grant History report, filtering on just scholarships, for the same Transaction Date range of one fiscal or calendar year for which the IRS 990 Grantee Schedule is being run.

Steps To Duplicate:

1. Go to Reports\Grants\Grant History Report - Opt by Grant

2. In Freq Used Fields delect on a date range of 1/1/2017-12/31-2017 (or whatever date range is appropriate for the foundations fiscal year)

3. In App History select (Grant) Scholarship? = Yes

4. Run the report and note the total on the bottom of the report

5. Go to Reports\Grants\Grantee Reports\IRS 990 Grantee Schedule

6. Select the same fiscal year as was used for the Grant History report

7. Select the same date range as was used for the Grant History report

8. Click OK and Run Report

9. Note in section 3 that the totals for scholarships do not match the grant history report

Answer:

This occurs due to the scholarship application, not the Grantee record, having an incorrect IRSOrgCode. This is not the same as the Org code on the Grantee record. Scholarships are considered by the IRS to be grants to individuals. The IRS-990 report has separate sections for Individuals and Organizations. Some Scholarships are being reported in the Organization part because the IrsOrgCode field has been incorrectly assigned as Organization. Scholarship Applications created in FIMS always get an IrsOrgCode = Individual (yes), regardless of the OrgCode value of the associated Grantee.

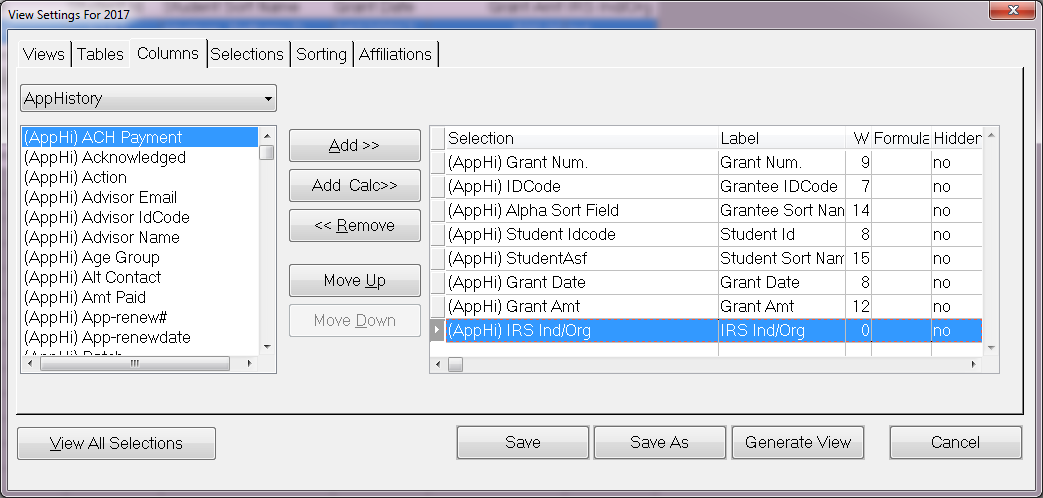

In the Scholarship Module on the Application History tab you can create a data grid to see what the coding is for a given application by outputting the IRS Ind/Org field:

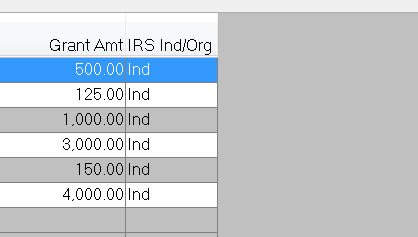

If this field shows Org, it needs to be changed to Ind:

In order to change all scholarship applications to from IrsOrgCode from Organization (no) to Individual (yes) you can run the audit tool called 'aud89152.p' located in \npo\found\FIMS\TOOLS. To run the tool complete the following steps:

1. Go to Tools\System Utilities\Run Procedure

2. Browse to 'aud89152.p'. Most likely for most foundations this will be on the N drive if run on a workstation..png)

3. Click OK, tool will run, you will not see anything pop up

4. Go to the scholarship module, note that scholarships will now have the Ind value for the IRS Code

5. Run the grant history report and the IRS 990 Grantee Schedule report as described above and note that they now match.