- Print

- DarkLight

- PDF

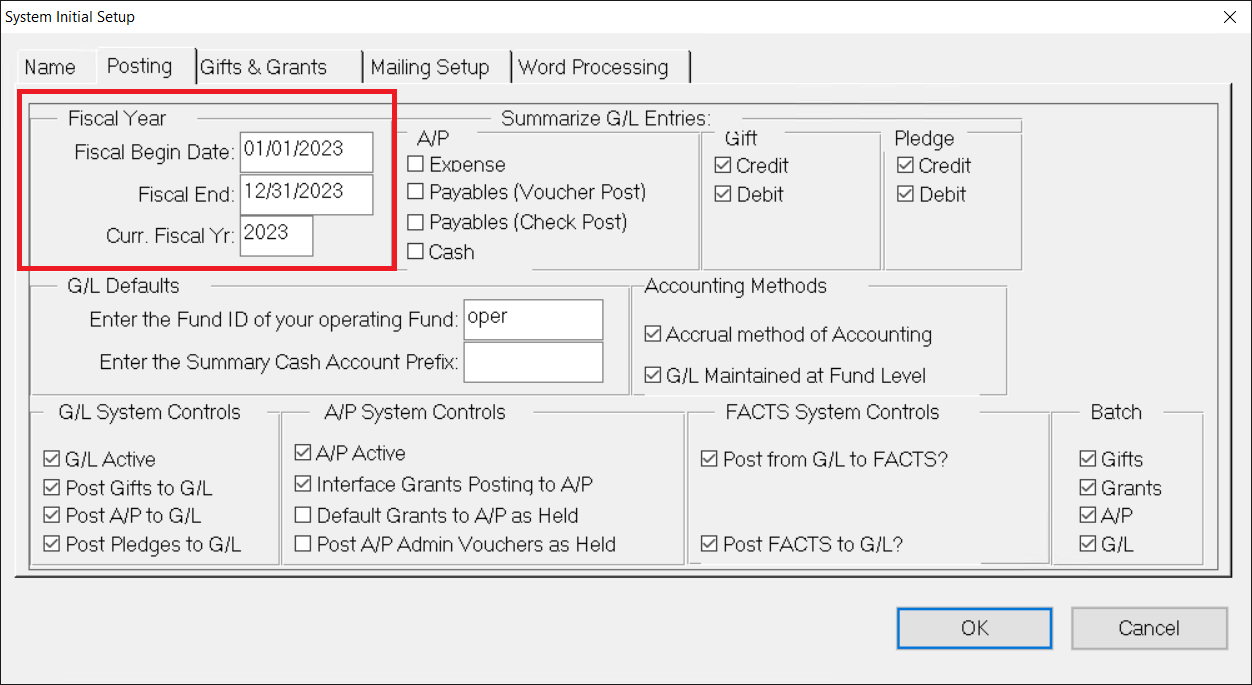

Selecting the Fiscal Year

The main purpose of the Fiscal Year fields is to determine the appropriate year for posting Gift and Grant summary history. For example, one organization could have a Fiscal Begin date of 02/01/2008 and a Fiscal End date of 01/31/2009 and call it their 2009 fiscal year, so the Current Fiscal Year field would be set to 2009. Another organization could have exactly the same fiscal year and call it their 2008 fiscal year, in which case the Current Fiscal Yr would be set to 2008.

The Current Fiscal Yr field is also used throughout the system for defaulting and validation. One example is that when running General Ledger reports, such as the Trial Balance or the YTD General Ledger, the year that is in the Current Fiscal Yr field will be used as the default (suggested) year to print the report for. When you do a look-up on the G/L Account records, the Current Fiscal Yr field is used to select the default records year that will be displayed.

It is perfectly normal to be in the first month of a new year and still have the three fields set to the last fiscal year. After all, you may still be closing the General Ledger for the previous year so it would be convenient to have last year defaulting into the reports and look-ups. When the majority of reports and look-ups are done for the new year is when the fields in System Initial Set-up should be updated.

- From anywhere in FIMS, select Tools > System Utilities > System Initial Setup. The System Initial Setup window opens.

- Click the Posting tab.

Posting Tab (Fiscal Year)

- Enter the Fiscal Year Begin Date for your fiscal year (for example, 01/01/2008 if you use a calendar-based fiscal year).

- Enter the Fiscal Year End date for your fiscal year (for example, 12/31/2008 if you use a calendar-based fiscal year).

- Enter the Current Fiscal Year.

- Click OK.

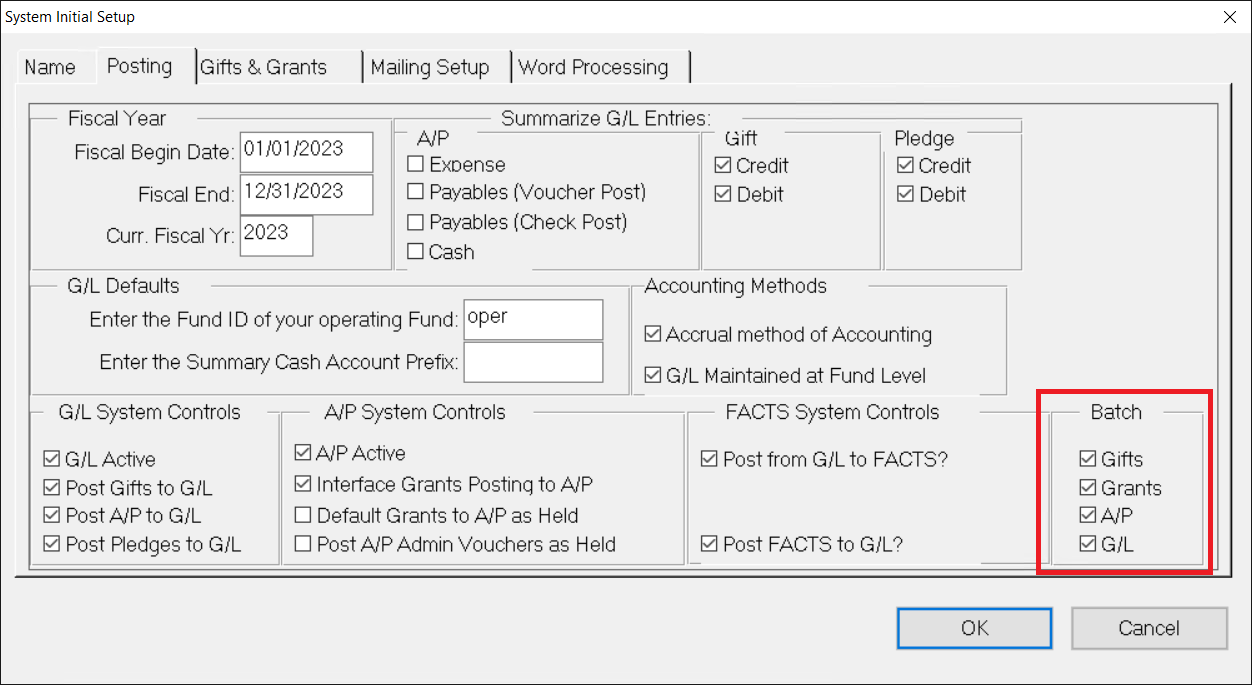

Activating the Batch Field for the General Ledger Journal

The Batch field is an optional field that you can use to identify Journal entries. If records that you post in the Donor and Gift Management or Accounts Payable modules contain information in the Batch fields, the corresponding Journal entries will contain the same batch information. If you create a manual Journal entry, you can use the Batch field as an extra text field. Any text that you enter in this field will automatically default into each subsequent entry.

- From anywhere in FIMS, select Tools > System Utilities > System Initial Setup. The System Initial Setup window opens.

- Click the Posting tab.

Posting Tab Batch

- In the Batch section, select the G/L checkbox.

- Click OK.