- Print

- Dark

- PDF

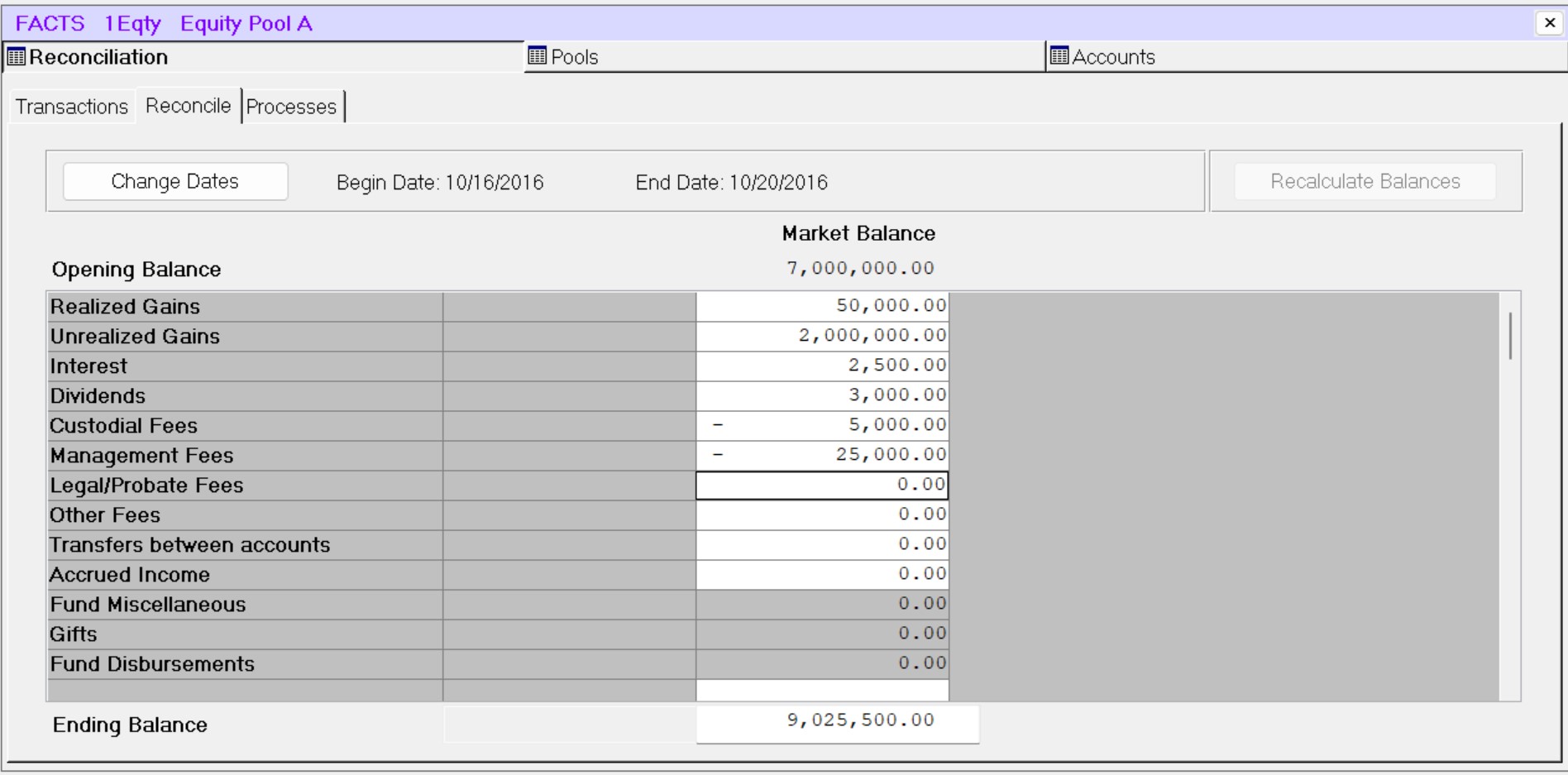

Reconcile Tab

The Reconcile tab allows you to enter returns and fees for the selected Investment Account, and to confirm the ending balance (the Transaction totals flow in from the confirmed Transactions within the current Cycle’s date range).

Reconcile Tab

Reconcile Tab Fields

NOTE: You can modify the field labels on these fields to match your organization's needs. Refer to Defining FACTS Labels for more information.

Field | Description |

|---|---|

Realized Gain / Loss | The realized gain or loss earned during the reconciliation Cycle. Gains must be entered as positive numbers, and losses as negative numbers. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). |

Unrealized Gain / Loss | The unrealized gain or loss earned during the reconciliation Cycle. Gains must be entered as positive numbers, and losses as negative numbers. This value will be allocated to all Funds. It is unique among the allocated values, because it will impact only the Market Balances in FACTS. |

Interest | The interest that was earned during the reconciliation Cycle. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). |

Dividends | The dividends that were earned during the reconciliation Cycle. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). |

Custodial Fees | The custodial fees that were paid during the reconciliation Cycle. Fees must be entered as negative values. Depending on the balance column where these fees are entered, they can impact Book, Market, and / or Income Balances. |

Management Fees | The management fees that were paid during the reconciliation Cycle. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). |

Legal / Probate Fees | The legal (or probate) fees that were paid during the reconciliation Cycle. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). NOTE: This field is sometimes used for allocable values other than fees (for example, accrued income changes). Please contact FIMS Support for more information about the available options for this field. NOTE: If a specific Fund has incurred legal expenses that should not be allocated, process the expense in General Ledger as a Journal entry without including it in the reconciliation process. Once you post it in General Ledger, it will appear as a Transaction to be confirmed for that Fund. |

Other Fees | The miscellaneous fees that were paid during the reconciliation Cycle. This value will be allocated to all Funds and will impact both the Market and Book Balances in FACTS (if both are maintained). NOTE: This field is sometimes used for allocable values other than fees (for example, accrued income changes). Please contact FIMS Support for more information about the available options for this field. |

Disbursements | You can use this field to record transfers of money into or out of the Pool, or transfers between Custodial Accounts within the Pool. If you are transferring money into or out of the Pool, you should allocate it equitably among the participating Funds. If you are transferring out of the Pool, you should enter the amount as a negative number. NOTE: If you use the Disbursements field for this purpose, you will want the Fund level disbursements to be treated as sell Transactions which will reduce each Fund’s units in the Pool but will not affect the unit value. To do this, set the Disbursement_Processing System Option to Transaction. Refer to System Options – FACTS for more information. If you are transferring money between Custodial Accounts, enter the amount you want to transfer as a negative number when you reconcile the account the money is coming from and as a positive number when you reconcile the account(s) the money is going to. NOTE: The total amount when the transfers are complete must net to zero to indicate that no money needs to be allocated outside of the Pool. |

Gifts / Donations | The total amount from confirmed Transactions with a Transaction Type code of GifP. This Transaction Type is typically assigned to Gifts that are posted from the Donor and Gift Management module (which have a GI Journal Key code) or transferred Gifts (which have a GP Journal Key code) This field is automatically populated based on the Fund level Transactions from General Ledger that you have confirmed for the Cycle. The Transactions that are totaled in this field will have an impact on the average daily units of the Fund where the Transaction occurred and the allocation the Fund will receive. NOTE: This is a Fund level value that is not allocated to all Funds. |

Fund Miscellaneous | The total amount from confirmed Transactions with a Transaction Type code of MscP. The Transactions that are totaled in this field will have an impact on the average daily units of the Fund where the Transaction occurred and the allocation the Fund will receive. NOTE: This is a Fund level value that is not allocated to all Funds. |

Fund Transfers | The total amount from confirmed Transactions with a Transaction Type code of TrnP. NOTE: This Transaction Type is often reserved for manual Transactions that are used to transfer dollars among Investment Accounts (within the Pool). It is also the default code for Transactions entered by the Close a Fund in the Pool process. Refer to Closing a Fund in a Pool for more information. NOTE: This is a Fund level value that is not allocated to all Funds. The Transactions that are totaled in this field will have an impact on the allocation. Based upon the Transaction type, Fund Transfers may impact Book, Market or Income accounts. |

Fund Disbursements | The total amount from confirmed Transactions with a Transaction Type code of DsbP. NOTE: This Transaction Type is the default code for Transactions that come from General Ledger with a Journal Key code of AP (checks paid from the Pooled Asset Account) or DP (a code for manual Journal entries that record disbursements from the Pool). The Transactions that are totaled in this field will have an impact on the average daily units of the Fund where the Transaction occurred and the allocation the Fund will receive. NOTE: This is a Fund level value that is not allocated to all Funds. |

Interim Earnings | The total amount of earnings that are calculated and allocated outside of FACTS (for example, via DonorCentral). These Transactions have a Transaction Type code of ErnP (the default code for Transactions that come from General Ledger with a Journal Key code of EP). NOTE: This is a Fund level value that is not allocated to all Funds. |