- Print

- Dark

- PDF

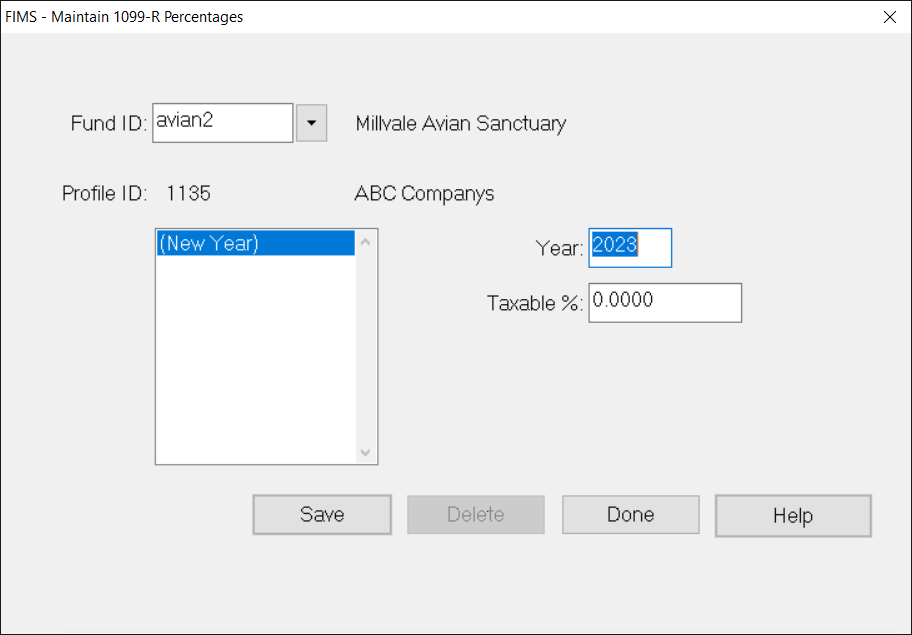

Maintain Taxable Portion of 1099-R Form

You can maintain the taxable portion of 1099-R form issued by FIMS on a Fund ID / Profile basis.

To set the taxable portion for a given fund and profile, navigate to File Maintenance > Maintain 1099-R Percentages.

When the Maintain 1099-R Percentages node is clicked, the Maintain 1099-R Percentages form is displayed with the first (alphabetically collated) Fund ID for which the 1099-R checkbox have been set on Fund 2 Tab of the fund form.

If the form is displayed with blank Fund ID, no Funds have their 1099-R check box checked and this form cannot be used. Below is an image of a form showing the avian2 Fund for which no percentages were set yet.

You will first have to identify the Fund by selecting a Fund ID (using the Fund ID drop-down) Upon selection of a Fund, the associated profile is populated and the form is ready for setting up taxable percentages for multiple years.

To set up the percentage for a given year, follow these steps:

Enter a valid year in the Year field (e.g. 2014)

Enter a percentage in the Taxable % field.

Click Save – a new row in the Years list will be created.

To set percentages for a new year, you may click the New Year row in the years list. A new (one higher than the current largest year) will appear in the Year field with 0.0000 in the Taxable% field. Set the Taxable% and click Save. The years list will be updated with that new year.

To change the percentage for a given year, highlight a year in the years list, enter the correct value in the Taxable% field and click Save. The years list will be updated.

To delete a year, highlight a year in the years list and click the Delete button. You will have to confirm your intention by clicking the Yes button on the confirmation message that appears.

Field | Description |

|---|---|

Fund ID | This drop-down is used for selection of the fund from which a 1099-R will be sent and for which percentages are to be set. Note: The drop down is populated only with those funds for which the 1099-R checkbox is checked on the Fund 2 Tab. |

Profile ID | A read-only field that is populated when the Fund ID has been selected. |

<unlabeled> Years List | A list showing the years with corresponding percentages set thus far for the Fund ID. The list is sorted in descending year order. |

Year | A four digit value indicating the year percentages are set for. |

Taxable | A positive number indicating the percentage to be used when preparing the 1099-R form for the Profile ID for the corresponding year. Note: The value must be positive but does not have an upper limit. |

Changed | Read-only field that indicates the date when the Distribution was last updated. |

By | Read-only field that indicates the user name of the person who made the last change to the Distribution (or the person who created the record if no changes have been made). |

Save | The Save button is used to save the Taxable% for a given year |

Delete | The Delete button is used to remove a Taxable% for a given year. It is only highlighted when a year in the Year List is selected. |

Done | The Done button is used to finish setting the percentage for a given Fund / Profile and close the form. |

Help | The Help button is used to access the standard FIMS Help facility |