- Print

- Dark

- PDF

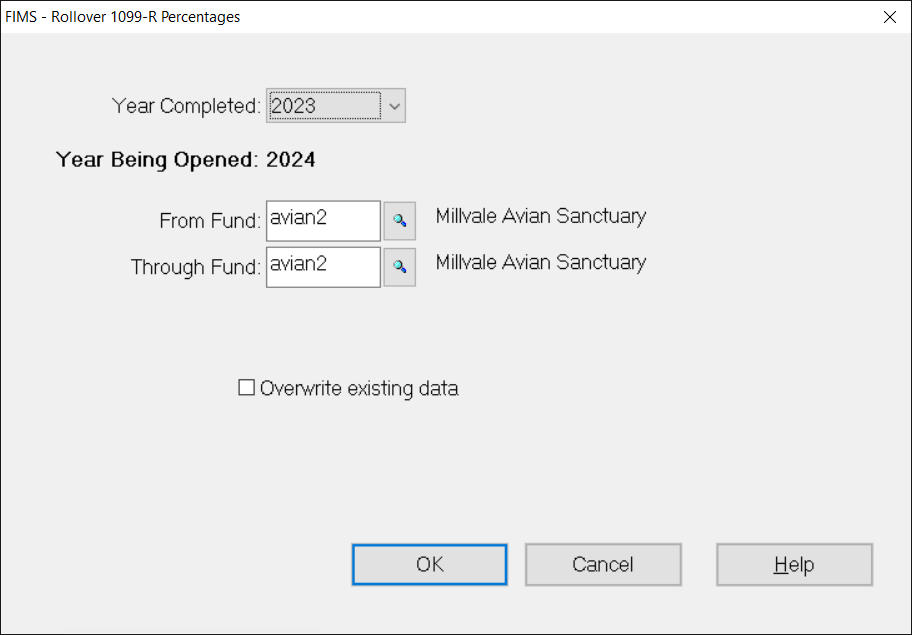

Taxable Portion Rollover Utility

A utility for rolling over entries from previous year is available. To access this utility, navigate to File Maintenance>Rollover 1099-R Percentages menu item.

The utility enables one to copy Taxable Percentages for Funds from one year to the next and is very useful when the percentages have not changed. The utility will verify that there were distributions in the prior year before creating a new record. This utility can also be run from the 1099-R report by selecting the Rollover percentages menu item. You can choose not to run it at this time and access the utility from File Maintenance later.

Field | Description |

|---|---|

Year Completed | The year from which to move entries. This is a drop-down populated with fiscal years for which entries subject to rollover exist. Select the year from which to rollover entries |

Year Being Opened | A read-only field that is populated with the year following Year Completed once a Year Completed have been selected. |

From Fund | The first fund from which to rollover entries that took place during the Year Completed |

Through Fund | The last fund from which to rollover entries that took place during the Year Completed |

Overwrite existing data | A checkbox that indicates whether to overwrite existing entries in the Year Being Opened or leave those untouched. |

OK | The OK button is used to roll the entries from the Year Completed to the Year Being Opened. Entries will be overwritten if the Overwrite existing data check box is selected and will not be affected if that check box is not selected. |

Cancel | Closes the form without action. |

Help | The Help button is used to access the standard FIMS Help facility |