- Print

- Dark

- PDF

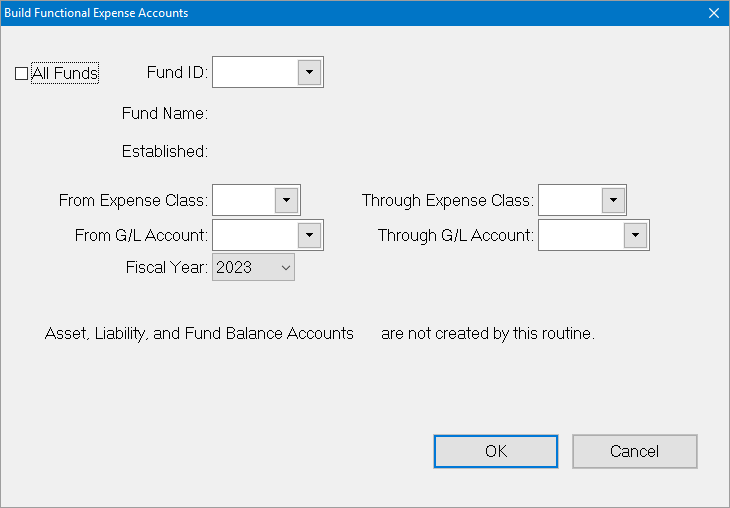

Build Functional Expense Accounts

The Build Functional Expense Accounts utility is an adjunct to auto-building General Ledger accounts. It is designed to automatically add accounts that have a specified Functional Expense segment.

Before you can create functional expense accounts using this utility, you must create the appropriate General Ledger accounts, with full Fund coding and a natural account number, but no functional expense segment. You must also set up the Functional Expense codes. See Maintaining Functional Expense Codes for more information.

Note: The End of Year Closing process reproduces these accounts in subsequent years.

In General Ledger , select File Maintenance > Build Functional Expense Accounts.

Build Functional Expense Accounts Window

Do one of the following:

To build expense accounts for all of your Funds, select the All Funds checkbox.

Warning: Selecting All Funds can lead to creation of faulty / unwanted accounts and should be carried with caution.

To build expense accounts for a specific Fund, clear the All Funds checkbox and enter the Fund ID code for the desired Fund.

In the From / Through Expense Class fields, enter the Functional Expense code(s) that you want to assign to the account(s).

In the From / Through G/L Account fields, enter the natural account number (or range of account numbers) that you want to assign the Functional Expense code to.

Click the arrow in the Fiscal Year drop-down box and select the fiscal year that you want to build the functional expense codes for.

Click OK. A confirmation message appears to make sure that you are ready to create the selected accounts.

Click Yes to create the selected accounts. A message will appear to tell you how many accounts were created.

Using Functional Expense Codes

The Functional Expense segment is usually used to break down operating expenses by department or functional area. You can roll-up these accounts for financial reporting if you want to present a single balance, or you can report on each account separately.

Most charitable organizations that use FIMS employ a General Ledger Segment Definition that includes a seventh segment – the Functional Expense segment. This segment is left blank for most accounts, but it can contain a functional expense code. For example, instead of a single Telephone expense account, you might have five functional expense accounts:

Functional Expense Code | Expense Type |

|---|---|

040NUoper 63500 | (Telephone Expense) – Parent Account |

040NUoper 63500 adm | (Telephone Exp. - Administration) |

040NUoper 63500 dev | (Telephone Exp. - Development) |

040NUoper 63500 pgm | (Telephone Exp. - Program) |

040NUoper 63500 msc | (Telephone Exp. - Miscellaneous) |

Note: Once you create the functional expense accounts, you can either delete the parent account or use it for the most common expenses (for example, administration), non-departmentalized expenses (for example, miscellaneous), or budgeting. You can also keep the account in your database without using it.

Using Functional Expense Accounts:

When you create vouchers in Accounts Payable, you can enter multiple line items and distribute an expense among these departments. While there is no facility to allocate the expense according to a pre-set, you can use Voucher Recall to create the line items, and just change the amounts.

Some organizations credit all expenses to the parent expense account, and make General Ledger entries at the end of the year to distribute the expenses among the departmental expense accounts according to an estimate of resource allocation.

Like standard General Ledger accounts, each departmental expense account record has a budget and an actual column, which allow you to enter budgets at the departmental level. Alternatively, you could enter budgets in the parent account, and use a financial statement to compare that budget to the sum of actual expenses in the departmental accounts.

You can also use functional expense accounts to track operating expenses that should be underwritten by an affiliate or other non-corporate Fund. However, if that is your goal you should consider directly crediting an expense account from the affiliate’s Fund, to avoid the subsequent interfund transfer to the Operating Fund.