- Print

- Dark

- PDF

Perform End of Year Closing

What are the end of year closing procedures?

To make year-end processing as simple as possible, FIMS allows you to keep General Ledger open for multiple years at the same time. For example, you could still be awaiting the closing entries for the current year while processing financial data for the previous year. This is achieved by simply making a new set of accounts for the coming year and bringing the balances forward into them, while leaving the accounts in the current year untouched.

Normal year-end processing consists of closing the General Ledger for the current year and establishing accounts for the new year. The G/L End of Year Closing utility performs the following functions:

Creates a set of General Ledger Account records for the new year, based on the current year’s accounts.

Note: If an account is set to Inactive and would have a zero balance in the New Year, the utility will not create it for the New Year.

Establishes the beginning balances for the balance sheet accounts in the New Year. The ending balance for the old year automatically becomes the beginning balance for the New Year.

Closes the Revenue and Expense accounts to the Fund Balance accounts in the New Year.

Clears the Revenue and Expense accounts in the New Year.

Note: You must run G/L End of Year Closing to create the General Ledger accounts for the New Year and establish the beginning balances for the balance sheet accounts.

Running G/L End of Year Closing

In General Ledger, select File Maintenance > End of Year Closing.

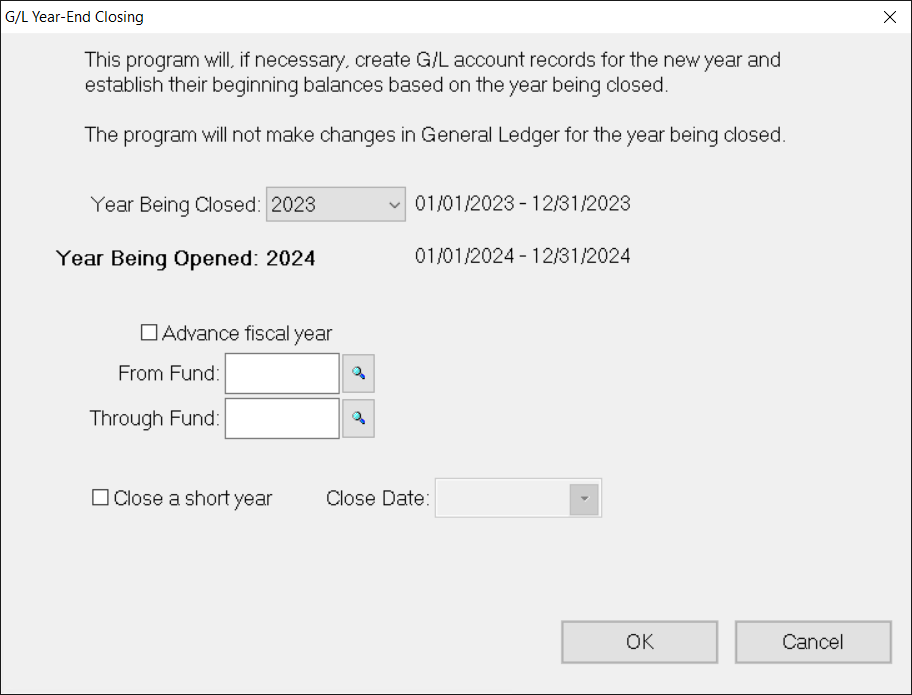

G/L Year End Closing Window

Click the arrow in Year Being Closed, and select the fiscal year to close.

To advance the fiscal year by one year, select the Advance Fiscal Year checkbox.

Note: IMPORTANT: Even if you run this utility multiple times, only select this checkbox once.

Note: To check the current fiscal year, select Tools > System Utilities > System Initial Setup, and then click the Posting tab. The Fiscal Begin Date, Fiscal End, and Current Fiscal Year appear in the upper left-hand corner of the window. See Selecting the Fiscal Year for more information.

Note: This process also creates the calendar for the new year, if it does not already exist. See Maintaining the General Ledger Calendar for more information.

If you are closing a short year, select the Close a Short Year checkbox and then enter the Close Date (the last day of the short year).

Note: IMPORTANT: You should only use this checkbox if you are changing your fiscal year. Make sure to close the short year before any posting is done to the New Year.

When you close a short year, the system will automatically create historical records for all fiscal years, if they do not already exist, based on the current fiscal year definition. However, you may change these settings via GL Calendar Maintenance, if necessary. Please contact FIMS Support for more information.

To run the utility for a specific Fund or range of Funds, enter the desired Fund ID codes in the From / Through Fund fields. If you want to run the utility for all Funds, leave both of these fields blank.

Click OK.

Rerunning G/L End of Year Closing

FIMS allows you to rerun this utility in order to bring forward balances that have been corrected due to End of Year adjusting entries. This functionality mirrors the accounting cycle for many organizations. For example, if your organization bases their fiscal year on the calendar year, you may want to begin budgeting in November, provisionally close the General Ledger as of December 31st (to begin capturing the information for the new year) and post the final End of Year closing entries in January or February when you receive them from your auditors.

To use this kind of staged, End of Year process, you would run G/L End of Year Closing three times:

In November, you will create the General Ledger account records for the New Year so that you can enter budgets. Beginning balances are brought forward but serve no purpose at this time. As would be expected absolutely nothing is done to the ledger for the old year.

In December, when it is time for the December 31st provisional closing you can run the utility to update the balances in the current year’s ledger and reproduce any new G/L accounts that were added since the closing that was done for entering budget amounts.

When you have the adjusting entries from your audit, you can make them to the last day of the old year and run a final G/L Year End Closing to correct the beginning balances for the New Year.

Additional End of Year Closing Details

Along with running the G/L Year End Closing utility, you should consider the following at in your End of Year process:

Grant Numbers: If your Grant application numbers reflect the application year, you will need to reset the starting number for the New Year. Refer to Resetting Grant Numbers in the Grantee and Grant Management module for more information.

1099 Forms: Remember to print your 1099 forms after you enter all of the checks (and hand checks) for the old year.

Note: You can run the 1099 Vendor Report and Forms before you actually print the 1099 forms. This report provides detailed information about the checks that have been paid to the 1099 vendors. After 1099's are complete, you should delete any 1099 Adjustment amounts from the Vendor record. Refer to Clearing 1099 Adjustment Amounts in the Accounts Payable module for more information.

If you use Asset Rebalancing, make sure to run the Copy Prior Year Targets utility after you run End of Year Closing.

End of Year Closing (Behind the Scenes)

When you run G/L End of Year End Closing, FIMS builds General Ledger accounts in the New Year for all active accounts in the old year. It does not build new General Ledger accounts for accounts that are marked as Inactive in the old year, unless their balance in the New Year will be greater than zero.

When you retire a Fund, all of its General Ledger accounts are automatically marked as Inactive. Refer to Retiring a Fund in the Fund Management module for more information.

You can also set individual accounts as Inactive by selecting the Inactive checkbox on the Account tab in General Ledger.

FIMS employs double entry booking methods, so the relationships among account types are represented by the sign of the normal account balances:

Account Type | Debit/Credit |

|---|---|

Assets | Debit (+) |

Liabilities | Credit (-) |

Balance | Credit (-) |

Revenue | Credit (-) |

Expenses | Debit (+) |

Note: The Fund balance normally has a credit balance (represented by a negative number).

When you run G/L End of Year Closing, the following operations take place behind the scenes to bring balances forward to the new year:

Asset and Liability Accounts

FIMS calculates the old year’s ending balance for each account by adding the balances for the previous thirteen periods to the amount in the Beginning Balance field.

The old year’s ending balance for each asset and liability account is carried over to the new year’s Beginning Balance field.

Fund Balance Accounts

Fund Balance accounts are more properly thought of as Beginning Fund Balance accounts. There are no values in any of the thirteen Period fields – only one in the Beginning Balance field, so the balance in these accounts does not change during the fiscal year.

Revenue and Expense account records never have a value in the Beginning Balance field – only in the thirteen Period fields.

During End of Year Closing, FIMS calculates the Fund balance by rolling revenues and expenses (the sum of the 13 period values) into the balance accounts in accordance with the following equation:

FUND BALANCE = BEGINNING FUND BALANCE + REVENUE – EXPENSES.

The normal balances are Fund Balance (-), Revenues (-), Expenses (+), and

Transfers (- or +), reflecting the following equation:

ASSETS – LIABILITIES – BEGINNING FUND BALANCE – REVENUE + EXPENSE = 0.

Note: If revenues are greater than expenses, the resulting change to the balance will be a negative amount. The result is added to the old year’s Ending Fund Balance (-) and entered in the New Year’s Beginning Fund Balance field. Revenue, Expense, and Transfer accounts begin the year with a zero balance.

The system closes activity accounts to the correct Fund balance based upon the account type codes you assigned to your General Ledger accounts (for example, R1-revenue, X1-expense and T1 transfers all close to the Q1-Fund Balance. R2-revenue, X2-expense and T2 transfers all close to the Q2-Fund Balance).