- Print

- Dark

- PDF

Maintain the Master Chart of Accounts

The Master Chart of Accounts is a template that is used to create a basic set of accounts for each Fund, according to the Fund Class.

How does the Master Chart work?

The Master Chart contains a record for every natural account number that can be used by any Fund. Each Master Chart record includes the natural account number, a description, an account type code, and a list of all Fund classes that need the account.

FIMS uses the Master Chart to initially build the General Ledger, and to build General Ledger accounts for new Funds. When FIMS builds accounts for a new Fund, it reads the Master Chart and builds the appropriate accounts when the new Fund’s Fund Class code is on the list. The Account Type in the Master Chart record is applied to each Account record that is auto built.

All Account records in the General Ledger should have a corresponding Master Chart record with the same natural account number. This is noteworthy for accounts that are entered directly into General Ledger via the Account tab or the General Ledger Accounts utility and are held by only one or two Funds. The Master Chart records for these accounts will have no Fund Class attached to them, but it is important to have these natural account numbers in the Master Chart to indicate that they are in use.

Note: In some cases, there should be two Master Chart records with the same natural account number. This is generally only necessary for investment revenue or expense accounts of pooled Fund Classes, when the account must close to principal (R1 or X1) for one class, and income (R2 or X2) for the other.

Note: Changing an account in the Master Chart doesn't automatically change the accounts in the General Ledger. However, if you change an account’s Description or Type, you are given the option to update that change to the General Ledger accounts for the available fiscal years.

Note: To add an account to all the members of a Fund Class (or several Fund Classes) after the General Ledger is built, first add it to the Master Chart, and then use G/L Account Mass Add / Delete to create the new accounts in the General Ledger. See Mass Adding/Deleting General Ledger Accounts.

The steps below explain how to add an account to the Master Chart. You can also use this utility to change or delete accounts.

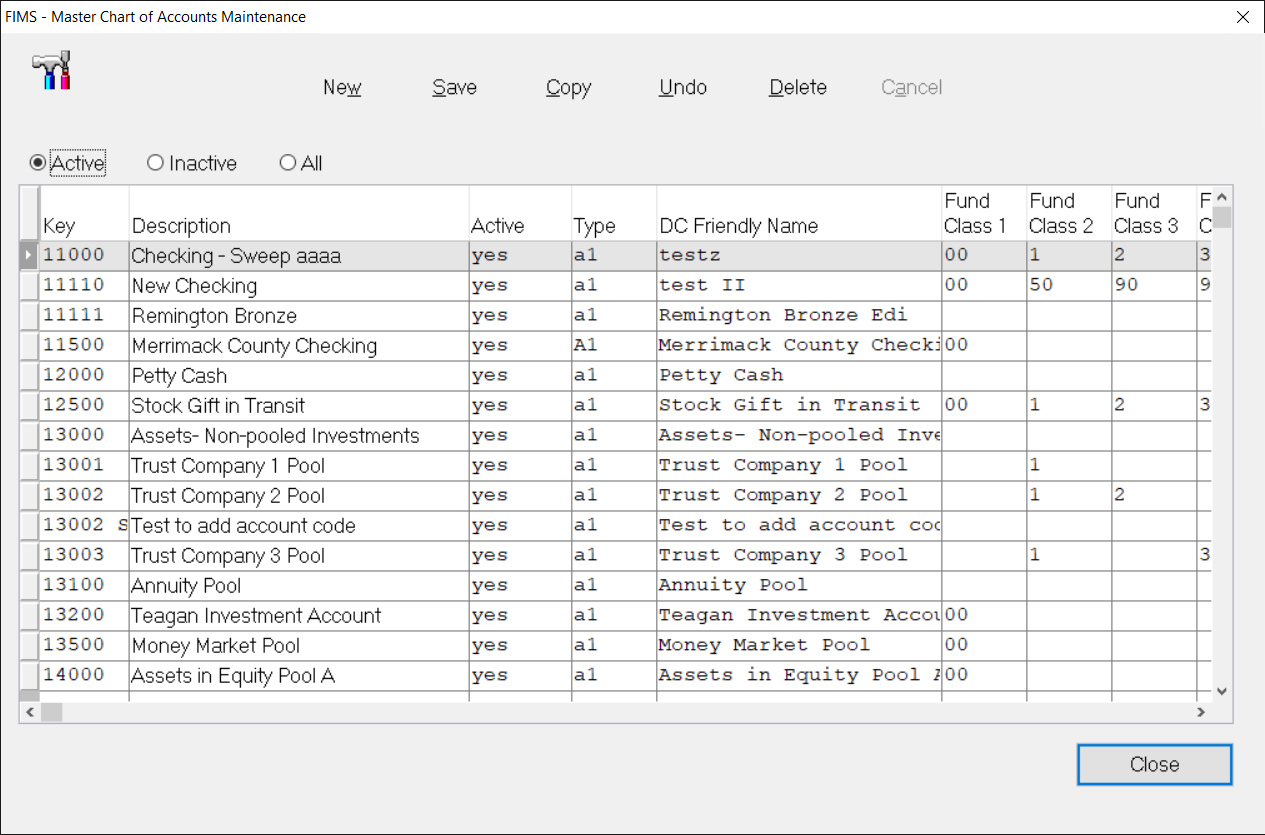

1. In General Ledger, select File Maintenance > Master Chart of Accounts Maintenance.

Master Chart of Accounts Maintenance Window Tip: Use the horizontal scroll bar to see all available fields.

Tip: Use the horizontal scroll bar to see all available fields.

2. Click New on the toolbar to open a new row for editing.

3. In the Key field, enter the natural account number for the new account.

4. In the Description field, enter a text description of the account (For example, how it will be used.).

5. Select the Type drop-down arrow and select the Account Type associated with the new account.

Tip: See Account Types for available codes and how FIMS uses them.

6. In the Fund Class fields (there are twenty of them), enter Fund Class code(s) for Funds that will use the new account. Each Fund Class field can hold one Fund Class code, and you can enter up to twenty different codes.

Note: For accounts that will only be used for a single Fund (or a few specific Funds), you do not need to enter any Fund Class codes.

7. (Optional) To summarize the account at the organizational level, click the Summarize drop-down arrow and select Yes.

Note: IMPORTANT: You should generally select No in this field (the default value). You should only select Yes when you are creating an asset account that you want to keep at the organization level in a Fund-level General Ledger. This technique may reduce General Ledger Journal entries, but it causes you to lose the accountability of a balanced set of accounts for each Fund.

Warning: Please contact Support before changing this setting to Yes.

8. Click Save on the toolbar.