- Print

- Dark

- PDF

Autobuilding FACTS Initial Fund Values

The Auto Build FACTS Initial Fund Values utility is designed to speed FACTS implementation. It can create initial Fund Balance records, Pool Balance records, and (if the Pool is invested in a single account), an Investment Account record and initial Account Balance.

If the Pool is invested in more than one custodial account, you must create the Custodial Bank Account record manually, and enter an appropriate Account Code in the Deposit Account Code and Disbursement Account Code fields on the Pool tab, before you run this utility.

NOTE: You can enter the initial Account Balances either before or after you run this utility.

Make sure you do the following before you run this utility:

- Create a Pooled Asset Account in General Ledger for each Fund that participates in the Pool. You must also manually enter an Ending Balance for the period prior to the first FACTS Cycle. Refer to Entering Opening General Ledger Balances in the General Ledger module for more information.

- If the initial FACTS Cycle is the first period of the initial fiscal year, the Pooled Asset Account Balances should be entered into the Beginning Balance field (Period 00).

- If the General Ledger keeps both Book (the primary Pooled asset account) and Adjustment to Market (which will be the offset for unrealized gains) accounts for each Fund, both accounts must exist and have the correct balances.

- Create a Pool record, including the General Ledger mapping (especially the Fund Asset account mapping). Refer to Creating Pool Records for more information.

- If the Pool is invested in more than one custodial account, create Investment Account records and enter the default Deposit / Disbursement Account codes to the Pool record (on the Pool tab). Refer to Creating Investment Account Records for more information.

NOTE: This procedure assumes that you are building the Fund values for an existing Pool.

1. In FACTS, select File Maintenance > Auto Build FACTS Initial Fund Values. A help window opens to give you more information about the utility. Be sure to read this information before you continue.

Help Window

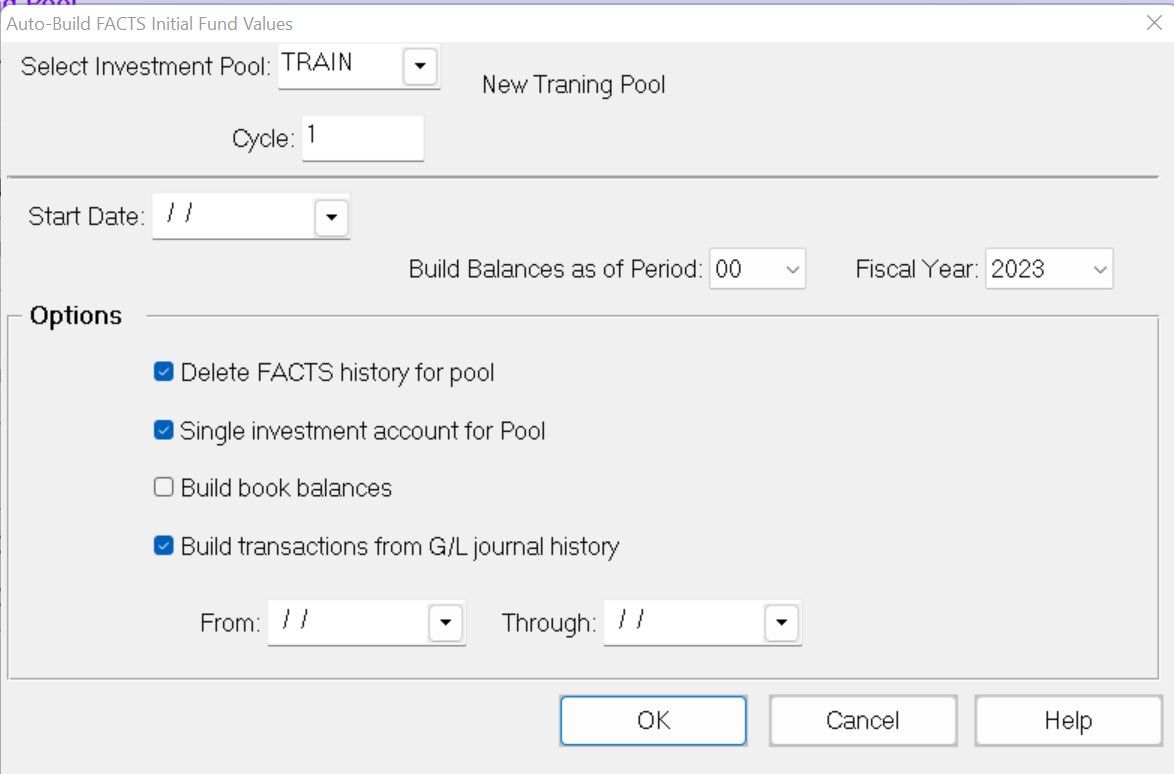

2. Click the Close button to close the help window. The Auto Build FACTS Initial Fund Values window opens.

NOTE: You can click the Help button on the Auto Build FACTS Initial Fund Values window at any time to re-access the help window.

Auto Build FACTS Initial Fund Values Window

3. Click the arrow in the Select Investment Pool drop-down box and select the Pool whose Fund Values you want to build.

4. In the Cycle field, enter 1. This is the number of the preliminary Cycle. The first Cycle that you will actually reconcile is Cycle 2.

5. In the Start Date field, enter the Begin Date for the first actual reconciliation Cycle.

6. In the Build Balances as of Period field, enter the General Ledger period prior to the month when FACTS will be initiated. If FACTS is being started the first period of the first fiscal year for which the Organization has created a General Ledger, enter 00 to use Beginning Balances. The default value is based on the Start Date.

NOTE: The beginning Pool total and Fund Balances are based on the balances in the Pooled Asset account (and optionally the Adjustment to Market account) at the end of the period you enter.

7. Enter the current Fiscal Year. The default value is based on the Start Date.

8. Clear the Delete FACTS History for Pool checkbox (the default value).

NOTE: You should only select this checkbox if you already attempted to build the Pool and canceled the process or were unhappy with the results and are running it again.

9. If you have not already created Account and Account Balance records, and you want to create a single Investment Account and initial balance, select the Create Single Investment Account checkbox.

NOTE: The Account Code and Name will be the same as the Pool ID code. But you can change the Name later via the Account tab. You cannot change the Account Code unless you manually create the Account record. Refer to Creating Investment Account Records for more information.

10. If you have two Pooled Asset accounts for each Fund (Book and Adjustment to Market), select the Build Book Balances checkbox. The Beginning Market Balance will be the sum of both accounts and the Beginning Book Balance will be the value of the Book account alone. If you have a single Pooled Asset account for each Fund, clear this checkbox.

11. If Transactions from General Ledger (that were meant to create FACTS Transactions during the first Cycle) were posted before FACTS was implemented, select the Build Transactions from G/L Journal History checkbox to retroactively pass the Transactions to FACTS. If none of these Transactions were posted before implementation, clear this checkbox.

12. If you selected the Build Transactions from G/L Journal History checkbox, enter the same date that you entered in the Start Date field through the current date in the From / Through fields.

NOTE: The From / Through fields are only available if you selected the Build Transactions from Journal History checkbox.

13. Click OK. The system will create a Pool whose beginning balance will equal the total of all assets in the Pooled Asset Accounts (and the Adjustment to Market account, if applicable), as of the Build Balances as of Period. It will also create Fund Balance records with Beginning Market Values (and Book Values, if applicable).

NOTE: If necessary after you run this utility, create Account Balance records in Custodial Bank Account Balances. The total beginning balance(s) from the first Cycle's bank account statement(s) should equal the Pool Balance. Run the Browse Initial Values utility to see if the Pool, Account, and Fund balances tie out with each other and with the bank statement(s). A possible source of difference could be in-transit items at the investment firms. If the balances agree, you are ready to process the Pool for the first Cycle. Refer to Reconciling FACTS Pools and Accounts for more information.

Tip: Items in Transit During FACTS Setup

If you use the Autobuild FACTS Initial Fund Values utility to create your Pool Balance, you may find a discrepancy between the beginning balance on your bank statement(s) and the Pool total that equals the sum of the General Ledger assets in Pool accounts for the individual Funds.

A possible source of this difference could be items in transit – Fund level Transactions that are reflected in the General Ledger accounts but were not processed at the bank in time to appear on the previous statement. These items are generally outstanding Transactions rather than part of the Beginning Balance, so that is how they should be set up in FACTS.

There are four steps involved in adjusting this situation. Please contact FIMS Support for help with this process.

- Identify the items in transit.

- If you have a single Investment Account for the Pool, and you selected the Create Single Investment Account checkbox when you ran Autobuild FACTS Initial Fund Values, then the Balance of that Investment Account must be changed by the total amount of the item(s) in transit. For example, if $15,000 in Gifts (to several Funds) are not reflected in the bank statement’s beginning balance, you must reduce the Ending Market (and Book, if applicable) balances by that amount.

NOTE: This step is unnecessary if you manually entered the initial Investment Account balance(s) rather than letting the utility create a single Investment Account with a starting Balance record.

- Use the Establish Initial Fund Values utility to make a net adjustment for each Fund that is affected by the items in transit. For example, if the Hunt Fund received a $5000 Gift that was reflected in the General Ledger Assets in Pool account, but did not appear on the bank statement, the Opening Market value (and Opening Book value, if it were being tracked) for the Fund in Establish Initial Fund Values must be reduced by $5000. When you run Establish Initial Fund Values the Pool Beginning Balances will be recalculated as the sum of the Investment Account Balances. You may then run the Browse Initial Values utility to confirm that the Pool, Account, and Fund balance totals agree. Refer to Establishing Initial Fund Values and Browsing Initial Values on this page for more information.

- Create FACTS Transactions that correspond to each in-transit Fund level Transaction:

- Run a Transaction Entry Listing, sorted by Document number. Refer to the Transaction Entry Listing in the Reports chapter for more information. Transactions must have a unique number for the Cycle.

- Add Transactions, and give each a unique sequential number. Make sure to use the appropriate Transaction Type code (GifP, DsbP, or MscP). The Date and Confirm Date should be the same. You should be able to get the date from the Transaction detail on the account statement. For Account, select the default Deposit / Disbursement Bank Account for the Pool. Enter the Fund ID of the appropriate Fund. Enter a Description. Enter the Amount as a positive value if it is a deposit, negative for a disbursement. The Pool will be filled in automatically (based on the Account).