- Print

- Dark

- PDF

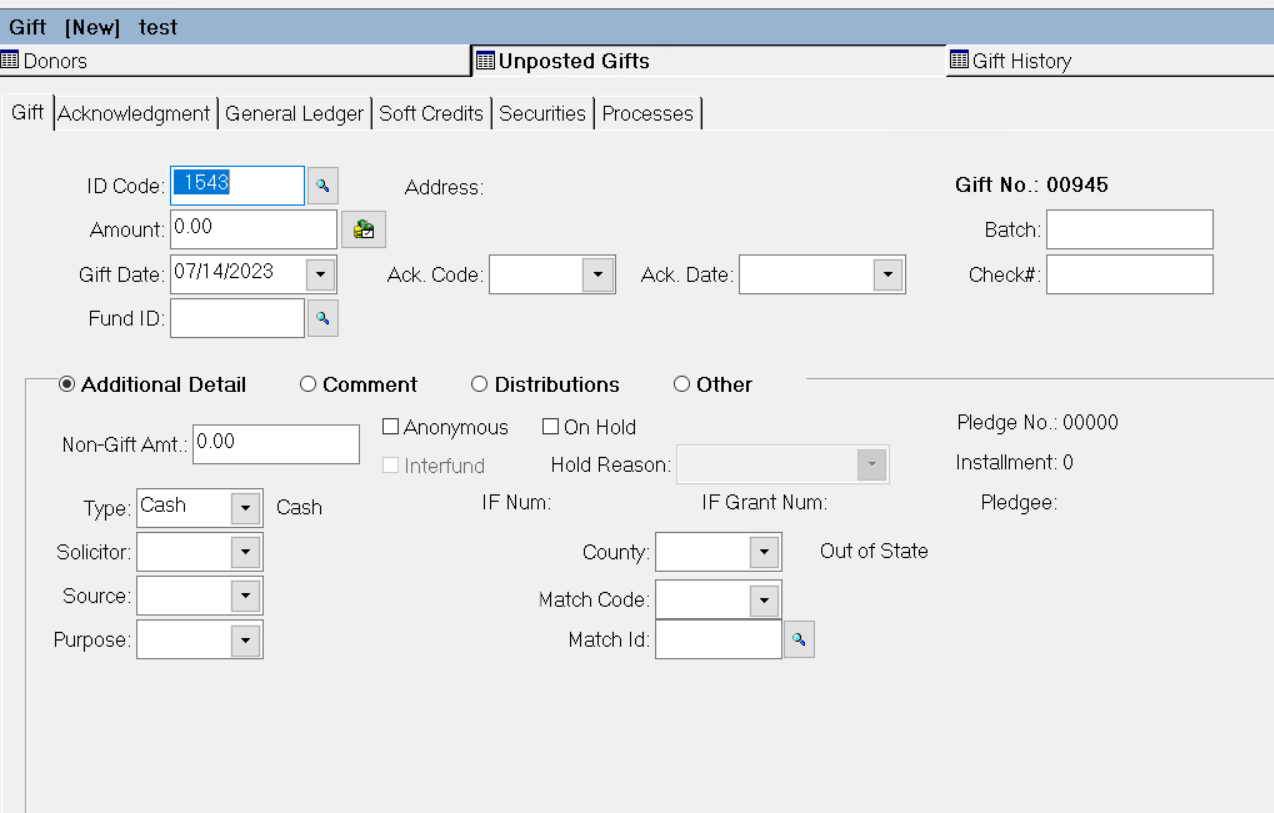

The Gift tab contains basic information about the Gift, including the Donor’s ID code, the Gift amount and date, and the Fund receiving the Gift.

Gift Tab

Gift Tab: General Entry Fields

Field | Description |

|---|---|

ID Code | Required The ID code of the Donor making the Gift. The default ID code is that of the Donor that was active when you created the new Gift (or the Donor that was selected in the Donor Data Grid). You can change the ID code by entering a new code or clicking the Lookup button (looks like a magnifying glass) next to this field to select a different Donor. Note: Once you enter an ID code, the Donor’s address (from the Profile record) will appear next to the ID Code field. |

Amount | Required The total dollar value of the Gift. |

Gift Date | Required The date when the organization took ownership of the Gift. The default value is the current date. You can use this date for the G/L apply date when you post the Gift or change the apply date at post time. Note: If you change the Gift Date for an unposted Gift, FIMS will notify you of any alternate addresses that the Donor may have for the selected date. You can choose to use the current address or the alternate address. |

Fund ID | Required The Fund ID for the recipient Fund (or the first recipient Fund if the Gift is divided between multiple Funds). When you save the Gift, FIMS will automatically build a single distribution line for the full Gift amount to the selected Fund. The appropriate debit and credit accounts (used when the Gift is posted) are automatically built based on the defaults in the Fund Class record. Note: It is possible to distribute a Gift to more than one Fund. Refer to the Distributions section of this tab for more information. Note: You can configure a System Option to automatically populate the Fund ID field for Donors that have a Fund Association with a particular Fund Rep code. Refer to System Options – Donor and Gift Management for more information. |

Ack. Code | User-defined code that indicates the type of acknowledgment letter the Donor should receive. This field is exported for use as a control field for mail merges. |

Ack. Date | The date when the acknowledgement letter was sent. Note: This field can automatically be populated when you export Gift Acknowledgments. |

Gift No. | The unique, sequential number used to identify the Gift. FIMS automatically assigns this number to each Gift, and it cannot be changed. |

Batch | The field that can hold a batch code or number to assign the Gift to a batch for posting. The default value is the batch code or number set for the selected Gift entry session, but you can change the code on a Gift by Gift basis. Note: This field will only be available if it is turned on in System Initial Setup. Contact FIMS Support for more information. |

Check # | The number of the check (if any) that was used to make the Gift payment. |

Gift Tab: Additional Detail Fields

Click the Additional Detail radio button on the bottom half of the Gift tab to access these fields.

These fields are used to store additional information about the Gift (for example, any non-Gift amount, whether the Gift is being made anonymously, the type of Gift, and whether the Gift qualifies for a matching donation).

Field | Description |

|---|---|

Non-Gift. Amt | The dollar value of any non-Gift receipts included with a Gift. Gift and non-Gift receipts may be entered in a single Gift record – in which case the actual check amount is the sum of the Gift Amount and Non-Gift Amount. You can use this field to enter exclusively non-Gift amounts (for example, miscellaneous receipts of money, returned Grants, or expense reimbursements). |

Anonymous | Checkbox that indicates whether the Gift is being given anonymously. When the checkbox is selected, the Gift is anonymous (the Donor’s name will not be printed on most Gift reports). When the checkbox is cleared, the Gift is not anonymous. Note: If the Anonymous checkbox is selected on the Donor record, then all Gifts from that Donor will be marked as anonymous by default. |

Interfund Gift | Read-only checkbox that indicates that the Gift is from one Fund to another Fund. You cannot manually select this checkbox. It is selected automatically when you create an Interfund Gift via the Interfund Module. When the checkbox is cleared, the default Gift cash, and revenue accounts will be used. When the checkbox is selected, substitute accounts will be used – as indicated in the default accounts of the Fund Class record for interfund gifts. |

IF Tran Number | For Interfund Gifts, read-only number that links the Gift together with its associated Grant in the Interfund Module. |

IF Grant Num | For Interfund Gifts, read-only field that displays the Grant Number for the associated Grant. |

On Hold | Checkbox that indicates whether the Gift is on hold for posting. This checkbox is cleared by default. When the checkbox is selected, the Gift will be excluded from the Edit and Posting process. |

Type | User-defined code that indicates the type of Gift (for example, Cash, Work of Art or Public Security). You can set a default code for this field via System Initial Setup. Refer to Setting the Default Gift Type Code for more information. |

Solicitor | User-defined code that identifies the primary solicitor who cultivated the contribution. Note: This field uses the same code table as the Solicitor field on the Donor record. |

Source | User-defined code that describes the means by which the Donor was persuaded to make this Gift. Note: This field uses the same code table as the Source field on the Donor record. |

Purpose | User-defined code that is used to track the intention of the Gift (for example, Challenge, Addition to Fund, or Pass Through). |

County | User-defined code that indicates the regional association for the Donor. It also can apply to Fund records and distributions. |

Match Code | User defined code that identifies the type of matching Gift that this Gift qualifies for (for example One to One). Note: If there is a Match Code defined on the Donor record, it will automatically be entered into this field for all Gifts from that Donor. Note: If you have the optional Pledge Management module, you can automatically create a Pledge from the matching Donor when the Gift is posted. Refer to the Pledge Management module for more information. |

Match ID | The ID code of the employer or individual that has agreed to match this Gift. Note: If there is a Match ID defined on the Donor record, it will automatically be entered into this field for all Gifts from that Donor. |

Pledge No. | If the Gift is fulfilling all or part of a Pledge, this field displays the Pledge Number of the Pledge being applied to this Gift. |

Installment | The number of the Pledge Installment that the Gift is paying. |

Pledgee | The Profile ID code of the Donor who made the Pledge. |

Gift Tab: Comment Field

Click the Comment radio button on the bottom half of the Gift tab to access this field.

The Comment field is a free-form text field that is intended for a comment or phrase to describe the Gift. It often is used to record the exact nature of non-cash Gifts (for example, 100 shares of Microsoft). It can also be used to provide additional details for memorial Gifts (for example, In memory of Ralph Harrison).

Note: For Interfund Gifts, if a Fund ID is entered into the initial six characters of the Comment field (and the Interfund Gift checkbox is selected), the Gift Detail of the Donor statement identifies the Donor Fund (for example, Transfer from the Adams Fund).

Comment Field

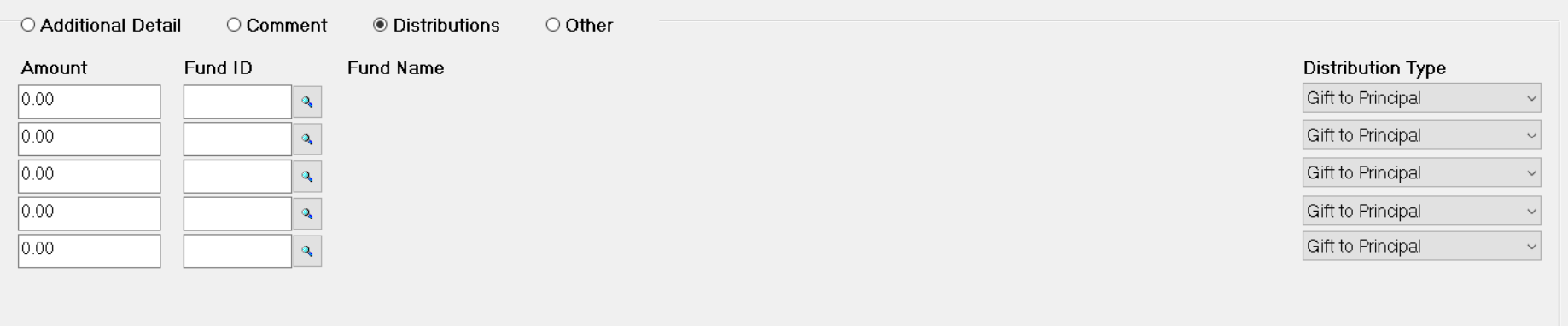

Gift Tab: Distributions Fields

Click the Distribution radio button on the bottom half of the Gift tab to access these fields.

Each Gift must be linked to at least one recipient Fund and may be distributed between as many as five Funds, using the five distribution lines.

When you enter a Fund ID on the top half of the Gift tab and save the record, one line is automatically created in the Distributions section for the full Gift amount. You can add additional distribution lines as necessary.

Tip: The sum total of all distribution amounts must equal the total Gift Amount.

Distributions Fields

Field | Description |

|---|---|

Amount | The dollar amount given to the Fund. The sum total of all distribution amounts must equal the total Gift Amount. |

Fund ID | The Fund ID for each recipient Fund. Note: When you select a Fund ID, the Fund Name automatically appears next to this field. |

Fund Name | Read-only field that displays the name of each selected Fund. This information is automatically added when you select a Fund ID. |

Distribution Type | Indicates the type of Gift for each distribution. The available types include Gift to Principal, Gift to Income, Non-Gift, and Non-Gift to Income. The Accounts on the General Ledger tab are built based on the default values in the Fund Class code table and the selected Distribution Type. For example, there may be a different default General Ledger account for a Gift to Principal versus a Gift to Income. Note: You can set a default Distribution Type in the Fund Class code table for each class of Fund. Refer to Maintaining Fund Class Codes in the Fund Management module for more information. Note: If you have the optional Stock Gift Management module, you will have two additional options: Securities Gift to Principal and Securities Gift to Income. Refer to the Stock Gift Management module for more information. |

Gift Tab: Other Fields

Click the Other tab on the bottom half of the Gift tab to access these fields.

Note: Along with general information about the Gift record, this section also provides basic information about Gift adjustments.

Other Fields

Field | Description |

|---|---|

Adjustment Date | Read-only field that indicates the date when the Gift was adjusted. Note: This information is only available for posted Gifts that have been adjusted. |

Adjustment Type | Read-only field that indicates the adjustment type code for the Gift (for example, S, R, or A for Source, Reversing, or Adjustment). Note: This information is only available for posted Gifts that have been adjusted. |

Gift No. | If you are viewing the original Gift that has been adjusted (Adjustment Type = S), this read-only field indicates the Gift number for the adjusting Gift record. If you are viewing a reversing Gift or an adjusting Gift (Adjustment Type = R or A), this read-only field indicates the Gift number for the original Gift. Note: This information is only available for posted Gifts that have been adjusted. Note: If the Gift has not been posted or if no adjustments have been made, 0000 will appear in this field. |

Adjusted By | Read-only field that indicates the username of the person who made the Gift adjustment. Note: This information is only available for posted Gifts that have been adjusted. |

External Source | Read-only field that displays the source of a Gift that was created externally to FIMS and then imported. |

External Gift ID | Read-only field that displays the ID code that was assigned to the Gift in an external application, before it was brought into FIMS. |

Gift Added | Read-only field that indicates the date when the Gift was first added to the system. |

Changed | Read-only field that indicates the date when the Gift record was last changed (or the date when the Gift was created if no changes have been made). |

By | Read-only field that indicates the username of the person who made the last change to the Gift record (or the person who created the Gift record if no changes have been made). |

.PNG)